Everyone has a different approach to modeling, but there are some key factors that separate good and great models. In this article, we'll go through the characteristics of great models, and how to improve model-building.

Every analyst has a different approach to building a financial model. Opening someone else’s model can feel like stepping into a watchmaker’s workshop. While we each take a different approach to modeling, there are key factors which separate good and great models. These aren’t commonly taught in business school and require some seasoning. Understanding the importance of exceptions, edge cases, and changes in trend takes time. Through repetition, a veteran analyst begins to appreciate the importance of balancing thoroughness with cleanliness and simplicity.

No analyst wants their PM to review their model and highlight a weakness. All-too-often, they throw the kitchen sink. The result can be an illegible mishmash. These five practices will elevate your modeling by guiding you on how to simply handle edge cases while focusing on what matters with the correct amount of detail.

1. Stress legibility, while minimizing unwarranted complexity

This seems simple enough. Keep your house tidy. Having non-uniform column syntax, poor labeling, and inconsistent formatting can lead to sloppy mistakes downstream. Many analysts dive into model creation with a loaded understanding of the company in their head. Before firing away, it pays dividends to think first of an external audience before laying down the groundwork. A great model plays at the tension of complexity to appreciate how a business works. It should be simple enough to be picked up by a different analyst. This foresight is the mark of a great analyst. It’s about being well thought out and planned.

2. Orient the model according to the true drivers of the business

Great analysts recognize the forest from the trees. Having a model which captures all the nitty gritty relays thoroughness and care, but a great analyst focuses her efforts on what truly matters. Often this means highlighting the right drivers. Doing so will create different outcomes. For example, driving SG&A as a percentage of revenue tends to be inferior / less accurate than driving it off headcount. A great analyst would know to use a more relevant and often correct driver. This will deliver a very different earnings per share estimate down the line. At the end of the day, the goal is to derive a non-consensus outcome for the security, and to be right!

3. Don’t Roll Up Numbers

Just as we emphasized the need for a model to surface the key drivers of the business, the model must not lose the necessary amount of granularity. This is often important when decomposing adjustments. By cutting these types of corners in rolling up numbers, the analyst loses the ability to perform deeper forensic analysis. While that may seem unnecessary at any given point in time, it becomes a painful exercise to correct in the future. A careful analysis of buried disclosures will assist in understanding the key drivers of, say, gross margin.

For example, in Daloopa’s financial model of Freshworks Inc (NASDAQ: FRSH), we capture the adjustments associated with GAAP / Non-GAAP reconciliation. The nature of this disclosure has changed over time, as evinced by the change in rows beginning in 2021Q3:

The work required in unearthing and documenting these changes can convince an analyst that the exercise wasn’t necessary to begin with. This is the type of attention to detail that allows a great analyst to shine.

4. Retain qualitative comments

With today’s increased mechanization of machine-readable information, much of the differentiated information in financial disclosure is found out of plain sight. These kernels can find themselves buried in the qualitative comments. Comments can be a richer hunting ground for discerning analysts to perform the type of work required to get to the bottom of management’s framing. The great analyst should be able to surface these qualitative insights within their model. While that seems daunting given the structured nature of excel, Daloopa model features such as linkback attribution make this a manageable process.

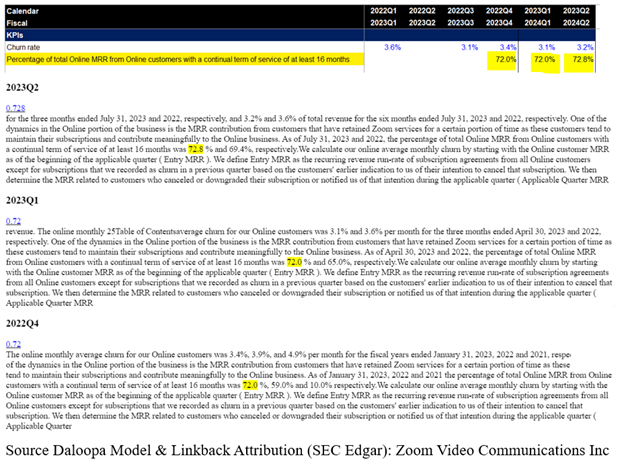

For example, look at the Daloopa financial model for Zoom, Inc. (NSDAQ: ZM), which captures the company’s reporting of MRR from Online Customers with at least 16 months of Continuous Service as a stated KPI. In our model, this KPI has linkback attribution to the beginning of this disclosure in 2022Q4, compared to the prior KPI of Churn which began in 2022Q1:

It’s important to keep note of management’s KPIs, especially as they’re changed. Being able to quickly identify a change in a stated KPI will allow the great analyst to interrogate why management chose to do so.

5. Holistically handling one-time exceptions

One-time exceptions are the enemy of the scalable and legible model, but they don’t constitute a hall pass for leaving this out of one’s model. Most good analysts can account for the impact of acquisitions, but the one-off FX impact or “anomalous circumstances” are often smoothed over. It’s a delicate balancing act, as we highlight the need for simplicity in point #1.

For example, let’s look at Klaviyo (NYSE: KVYO), a fresh IPO. In their S-1, management highlighted the one-time nature of a restructuring expense. The screenshot below highlights how Daloopa captures this exception without sacrificing legibility, ensuring that information is captured and available for the future.

How we help analysts make the jump from good to great

Ultimately, the leap from good to great takes more than raw horsepower, training, or experience. It takes levels of pattern recognition, repeated exposure to edge cases, and the learnings gained by socializing one’s work. While these five tips won’t immediately elevate you into stardom, they just might set you on your way.

To dig deeper, sign up for a free Daloopa account. With it, you’ll be able to download five free models. Take a look for yourself at the FRSH, ZM, and KVYO examples. Daloopa equips analysts with sanitized, tight, and legible financial models, taking the headache out of handling edge cases, while capturing the key insights.

Use the deepest and most accurate set of public company historicals to build your models in your preferred method, and update existing models in any formatting.