Effective financial modeling is crucial for making informed decisions, especially when quick adjustments are necessary. Properly structured and formatted models enhance adaptability, allowing for swift changes, reducing errors, and saving time.

Adopting best practices such as consistent cell styles, clear labeling, and modular design significantly improves the readability and flexibility of these models. This approach not only supports prompt scenario planning but also allows for accurate and speedy financial statement updates, making financial models powerful tools for strategic decision-making.

Key Takeaways

- Consistent formatting ensures rapid adjustments.

- Clear labeling and modular design improve model adaptability.

- Flexibility in financial models supports quick scenario analysis.

Formatting Principles

Effective financial model formatting allows for quick adjustments and readability. This section discusses key formatting principles including consistent formatting, clear structure, color coding, font choices, and currency symbols.

Consistent Formatting Throughout the Model

We must maintain uniform formatting across all sheets of a financial model. This includes using the same date formats, number formats, and cell styles. Consistency helps users who are navigating the model understand the information quickly and reduces the chances of errors.

For instance, if one tab uses the format “MM/DD/YYYY,” all other tabs should follow suit. Additionally, ensuring that headers, footers, and column widths are uniform across sheets gives a professional look.

Clear and Logical Structure

Our models need a structure that is clear and logical. This involves breaking down the model into distinct sections like inputs, calculations, and outputs. Users should easily find and understand each part without having to trace through the entire model.

Creating a table of contents or a navigation sheet at the beginning of the model can guide users. Arranging the content in logical steps helps others follow the flow of data and calculations.

Effective Use of Color Coding

Color coding is a valuable tool in financial models. We can use it to distinguish between inputs, calculations, and outputs, making the model easier to read and understand. For example, inputs may be in blue, calculations in black, and outputs in green.

Using color codes helps users quickly identify different types of data and reduces the likelihood of accidental changes to formulas. Consistently applying these colors across all sheets ensures clarity.

For example, in our models blue always means a hardcoded number. These data points will always have a link to the source document. Black means a calculated number, which is simple, but effective.

Appropriate Font Size and Style

The choice of font size and style is crucial for readability. We should use a standard font such as Arial or Calibri, which are easy to read on screens and in print. A font size between 10 and 12 points is typically appropriate for body text, while headings can be slightly larger.

Using bold text for headings and important figures helps them stand out, ensuring critical information is not overlooked. Italics can emphasize secondary details without overwhelming the reader.

Consistent Use of Currency Symbols

In financial models, currency symbols must be used consistently. If we are dealing with multiple currencies, it is essential to clearly denote each one to avoid confusion. For example, using “USD” for U.S. dollars and “EUR” for euros.

Consistent application of currency symbols ensures that users can easily differentiate between different financial figures. This practice not only clarifies data but also aids in avoiding costly mistakes in financial interpretation.

Formatting Tips

Effective formatting in financial models ensures ease of use and quick adaptability. We will explore essential techniques for formulas, formatting features, copy-pasting, error checking, and more to streamline your financial modeling process.

Using Formulas and Calculation Techniques

Consistent units and proper referencing are key. Avoid volatile functions like OFFSET and INDIRECT as they can slow down the model. It is important to regularly audit formulas for accuracy.

Utilizing Formatting Features in Excel

Proper formatting makes models more readable. Consistently use cell formatting with bold headers, colored cells for inputs and outputs, and gridlines for clarity. Conditional formatting is excellent for highlighting key metrics and trends. Setting protection locks on critical formula cells ensures they are not accidentally altered. Consider using templates to maintain uniformity across models.

Copy-Pasting and Its Implications

While copy-pasting can save time, it can also introduce errors. We should use Paste Special options like Values to avoid transferring unwanted formatting or formulas. Be cautious of relative references which might need to be adjusted after pasting. It is advisable to document any large-scale copying and pasting to track changes and maintain consistency.

Error Checking and Risk Mitigation

Error checking is critical for the reliability of a financial model. Utilize Excel’s Error Checking tool and frequently audit your formulas. We can set up checks at strategic points to validate outputs, such as comparing totals against known values. Building in warning indicators using conditional formatting helps highlight potential issues promptly.

Hard Coding Vs. Dynamic Formulas

Hard coding involves directly entering numbers into the model, which can be quick but prone to errors. Instead, we should use dynamic formulas that update automatically with changes in data. Named ranges and cell references enhance the adaptability of models. However, for some exceptions like assumptions or fixed values, hard coding can be practical if properly documented.

Utilizing Index-Match Function for Efficient Data Retrieval

The INDEX-MATCH combination is superior to VLOOKUP for data retrieval due to its flexibility and performance. INDEX returns the value of a cell in a specified array, while MATCH finds the position of a value. By combining these functions, we can create more robust and accurate lookups, even with large datasets or varying column arrangements.

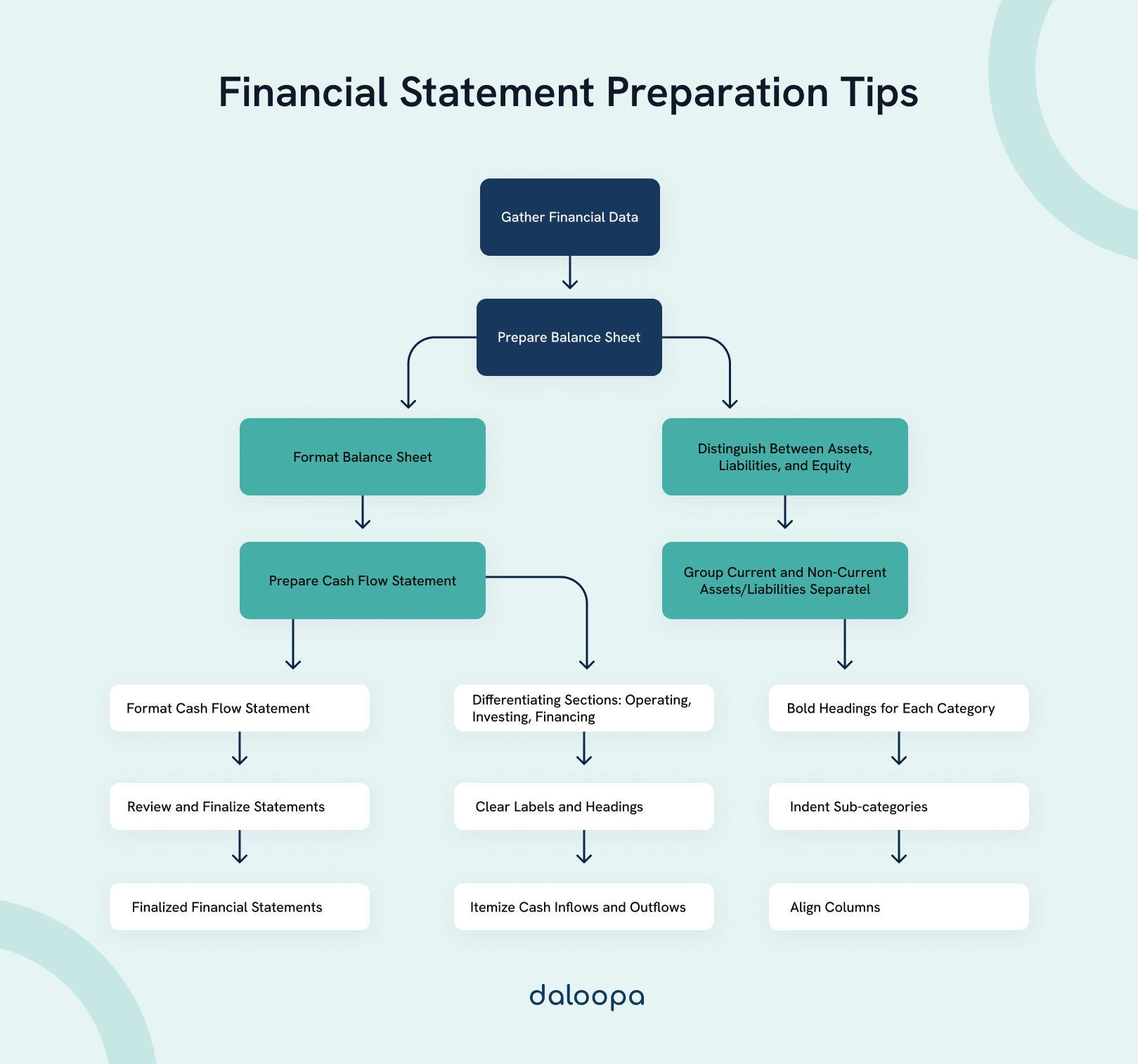

Advice for Formatting Financial Statements

Proper formatting of financial statements ensures that data is easily readable and adjustments can be made efficiently. Key aspects include structuring the balance sheet for clarity, organizing the cash flow statement effectively, and maintaining consistency across all financial documents.

Formatting Balance Sheet

The balance sheet should be formatted to distinguish clearly between assets, liabilities, and equity. Grouping current and non-current assets and liabilities separately can enhance readability.

We use bold headings for each category and ensure all sub-categories such as inventory, accounts receivable, and accounts payable are indented for easy identification. Columns should be aligned, showing amounts in a uniform decimal format. This makes it easier for users to skim and locate specific figures.

Formatting Cash Flow Statement

In a cash flow statement, it is important to differentiate sections related to operating, investing, and financing activities. We use clear labels and headings for each section. Each cash inflow and outflow should be itemized under the appropriate category. This helps in quickly identifying the sources and uses of cash.

Importance of Consistent Formatting Across Financial Statements

Consistency in formatting across all financial statements improves readability and reduces errors when adjustments are needed. We ensure that the same font, spacing, and decimal marking are used. Consistent color coding for headings and subheadings can also be helpful.

Additionally, using the same date format and unit of currency ensures there is no confusion. For example, if we use a comma or period for separating thousands, the same should be applicable across all statements. This uniformity allows for quick cross-referencing and comparison, providing a comprehensive view of the financial health of the entity. Maintaining this level of consistency improves the overall reliability and usefulness of the financial data presented.

Techniques for Rapid Adjustments

Rapid adjustment techniques in financial models ensure swift adaptation to new information. Predefined variables and dropdown menus streamline this process, allowing us to adjust inputs quickly without compromising data integrity.

Using software features like macros and scripted automation can expedite recalculations. Additionally, maintaining a modular model structure means updates in one area do not disrupt the entire model.

Keeping historical data readily accessible aids in comparative analysis. Overall, flexibility in model design ensures that we remain responsive to shifts in the business environment.

Looking to Streamline Your Financial Analysis?

Daloopa’s tools can help you ensure consistency, clarity, and adaptability in your models. Enhance your financial analysis process and keep your models up-to-date with the latest data effortlessly. Create a free account to sample our data and explore how our AI-driven tools make rapid adjustments easier and more efficient.