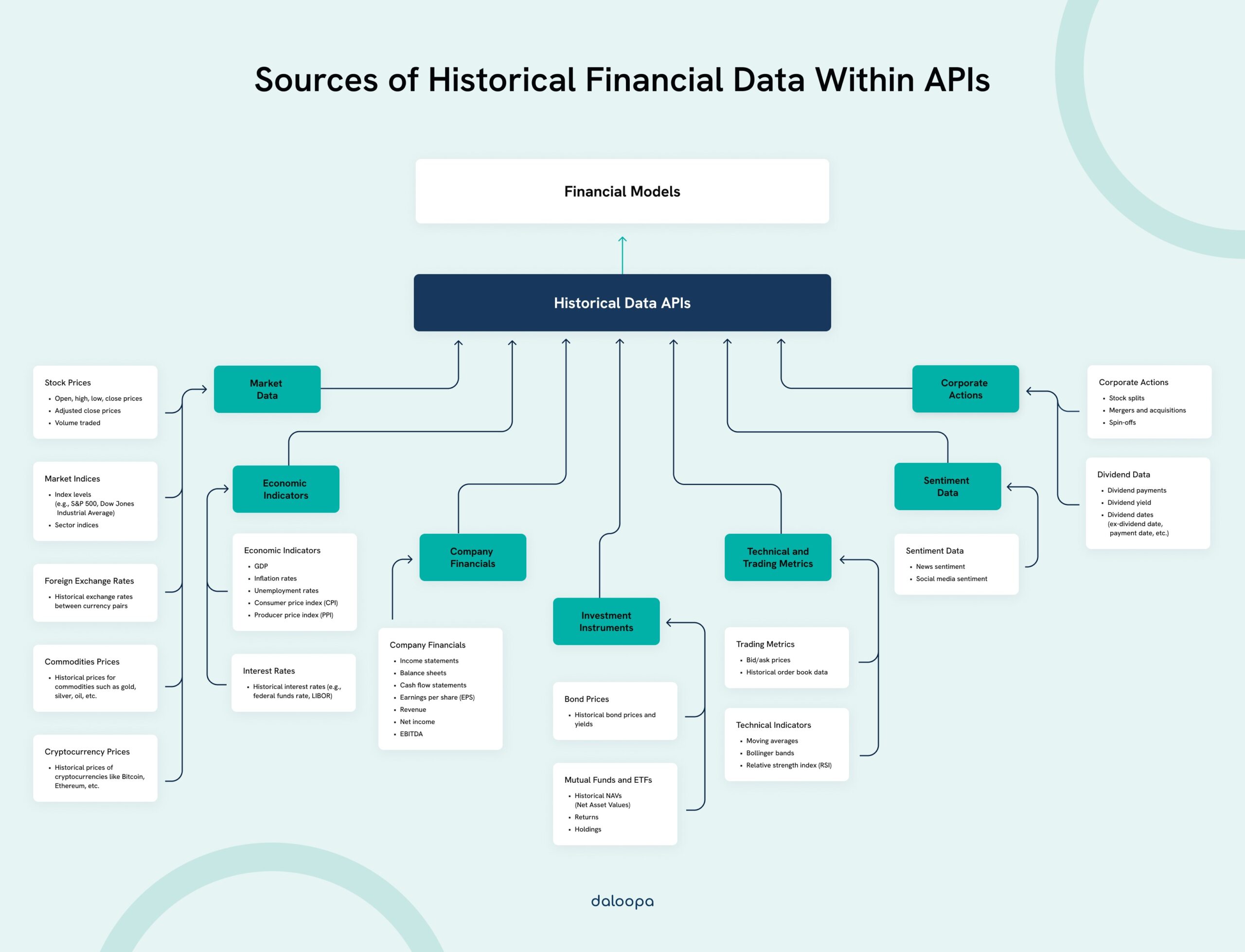

In the modern financial industry, accessing and using historical financial data APIs has become a game-changer. These APIs allow us to retrieve and analyze vast amounts of market data that were previously discarded at the end of each day. APIs simplify the way we access historical financial data, enabling us to make informed decisions and develop smart strategies.

With historical financial data APIs, we can examine past trends and patterns in the market. This can help in predicting future movements and assessing the overall economic climate. Open APIs not only provide this critical data but also allow third-party developers and institutions to create new financial tools and services, driving innovation in the field. That said there are a variety of AI driven excel integrations on the market, including our own at Daloopa that meld right into your current workflow and financial models without the need for complex APIs.

5 Popular Historical Financial Data APIs

There are several APIs that provide access to historical financial data, each offering unique features and benefits. We will look at some of the most widely used options for obtaining historical stock prices, cryptocurrency data, fundamental data, and technical indicators.

IEX Cloud

IEX Cloud offers a robust financial data service tailored for developers and businesses requiring reliable and comprehensive market data. It provides an extensive range of financial data with a focus on transparency and accuracy.

Key Features:

- Stock Prices: Comprehensive historical and real-time data for US and international stocks.

- Dividends and Splits: Detailed information on historical dividends and stock splits.

- API: A well-documented RESTful API with support for real-time and historical data queries.

IEX Cloud stands out for its commitment to data accuracy and transparency. It is a preferred choice for developers and financial analysts seeking high-quality data without the high costs associated with some other services. Its flexible pricing models make it accessible for both small developers and large enterprises.

Tiingo API

Tiingo offers a financial data platform that caters to both individual developers and financial institutions. It provides a wide range of historical and real-time market data with a focus on flexibility and user accessibility.

Key Features:

- Stock Prices: Detailed historical and real-time data for US and international stocks.

- News and Sentiment: Access to financial news and sentiment analysis.

- API: A user-friendly RESTful API that supports a broad range of financial data queries.

Tiingo is distinguished by its commitment to providing high-quality data at an affordable price. It is especially popular among independent developers and small financial firms due to its flexible subscription plans and comprehensive data offerings. Its combination of detailed market data and sentiment analysis tools provides users with a well-rounded view of financial markets.

MarketStack

MarketStack is a modern API designed for ease of use and reliability. It provides real-time and historical data for a wide range of financial instruments.

Key Features:

- Stock Prices: Covers over 70 global exchanges, providing robust historical data.

- API: Offers a simple, RESTful API for easy integration.

- Crypto: Limited cryptocurrency data among other financial data.

MarketStack is designed for those who need quick and easy access to a vast amount of historical financial data. Its simplicity, combined with a generous free tier, makes it accessible for individual developers and startups. For more comprehensive needs, various paid plans are available that scale with usage.

Alpha Sense API

AlphaSense provides a market intelligence platform designed for enterprises needing in-depth financial and market analysis. It integrates a wide array of data sources to deliver comprehensive historical and real-time financial data.

Key Features:

- Market Intelligence: Access to a broad spectrum of financial documents, news, and market data.

- AI-Powered Search: Advanced AI capabilities to facilitate deep searches within financial documents.

- API: Provides an extensive and scalable API to integrate market intelligence into enterprise systems.

AlphaSense excels in offering a holistic view of market data and intelligence, making it invaluable for investment firms, financial analysts, and large corporations. Its strength lies in the depth and breadth of its data sources and its advanced search capabilities powered by AI.

Polygon.io

Polygon.io provides a high-performance financial market data service with extensive historical data coverage. It is tailored towards developers needing detailed stock and cryptocurrency data.

Key Features:

- Stock Prices: Detailed historical data for US stocks.

- Crypto: Real-time and historical data for cryptocurrencies.

- API: High-frequency data with a clearly structured RESTful API.

Polygon.io stands out due to its high-performance data feeds and extensive coverage. It’s a favorite among quantitative traders and those requiring high volumes of data with low latency. While its focus is primarily on US markets, it offers some of the most detailed and reliable historical data available.

By covering services like Alpha Vantage, Yahoo Finance API, MarketStack, and Polygon.io, we provide a range of options tailored to different needs, from casual traders to professional analysts. Each API offers a unique set of features that can meet various historical financial data requirements effectively.

Key Features of Historical Financial Data APIs

Historical Financial Data APIs offer various features crucial for efficient and effective access to financial data. These features ensure comprehensive coverage, real-time updates, and robust accessibility and scalability.

Data Coverage and Types

Historical Financial Data APIs provide extensive data coverage, encompassing various financial instruments such as stock data, crypto data, forex, and other market data. Accessing records going back several decades can be vital for analysts to discern long-term trends.

Financial data types include but are not limited to price histories, trading volumes, and earnings reports. These APIs also cover broader market data, offering insights into different sectors and indices. This variety ensures users have a holistic view of the historical financial landscape, aiding in accurate analysis and forecasting.

While historical data is paramount, the ability to merge it with real-time data is a significant feature of modern financial data APIs. Real-time market data allows users to track changes as they happen, offering a complete picture from past trends to current market movements.

Updates are frequently pushed to stay aligned with live market conditions, providing users with up-to-the-minute stock market API and crypto data. This combination of historical and real-time updates helps users make informed decisions based on the comprehensive dataset that these APIs offer.

Accessibility and Scalability

Accessibility is critical when working with extensive historical datasets. Financial Data APIs are designed to be user-friendly, often requiring just an API key for access. They support various formats, making data integration straightforward for different applications.

Scalability ensures that these APIs can handle large volumes of data and high request loads without compromising performance. As user demands grow, whether for more historical data or increased real-time feeds, scalable solutions ensure continuous and smooth operation. Users can thus rely on these APIs to deliver consistent performance, regardless of the scope or scale of their data requirements.

Working with Common API Data Formats and Structures

When using APIs to access historical financial data, understanding data formats and proper API documentation is crucial. Our focus will be on JSON and CSV formats, which are the most commonly used in financial data feeds.

JSON and CSV Data Formats

JSON (JavaScript Object Notation) is a lightweight data format often used to exchange data between a server and a web application. It is easy to read and write, making it popular for APIs. In financial data, JSON encapsulates data in an object structure. For example, historical market data might include objects for each day with properties like date, open, high, low, and close prices.

CSV (Comma-Separated Values) is another common format. It stores tabular data in plain text. Each line of a CSV file corresponds to a row in a table, where columns are separated by commas. Financial data in CSV might include several rows, each representing a ticker symbol or stock data at different times. We often use CSVs for their simplicity and compatibility with spreadsheet software.

Understanding API Documentation

API documentation acts as a guide, helping us understand how to interact with an API. Good documentation explains endpoints, request methods (like GET and POST), and data formats used in responses. A Restful API documentation should specify URI structures, query parameters, and necessary headers. For instance, to fetch historical stock data, we might need to use a specific endpoint and pass parameters like the ticker symbol and date range.

While working with APIs, we also need to be mindful of rate limits, authentication methods, and error handling explained in the documentation. This ensures we can handle data feeds efficiently without hitting any unexpected roadblocks. Properly reading and understanding API documentation enables us to integrate and benefit from various financial data sources seamlessly.

By adhering to these guidelines, we ensure smooth and effective use of historical financial data APIs without complex software. Leveraging both JSON and CSV formats prudently. With a clear grasp of documentation, accessing and integrating data becomes manageable and efficient.

Skip the API Integrations (and Waiting For Developers) with Daloopa

Our AI Modeling Copilot melds right into your workflow and financial models. You can leverage our excel connector for the deepest, most accurate, and auditable set of public company historicals to initiate coverage in your preferred formatting and update your existing models faster to cover more companies every quarter. Sample our data with a free account to better understand how much time we can save you daily.