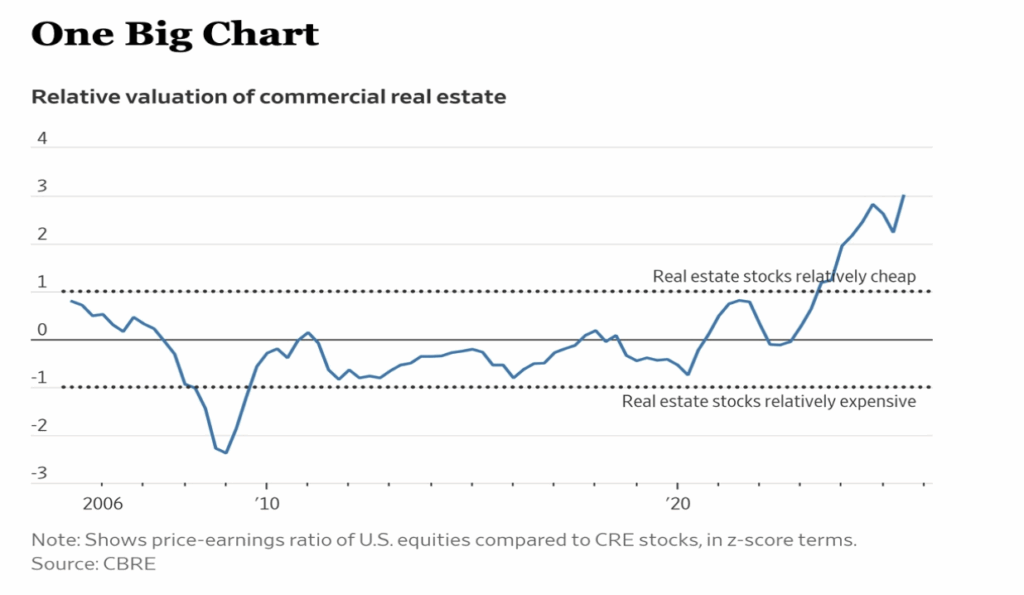

Commercial real estate stocks are trading at historically cheap valuations relative to broader equities. According to CBRE, the relative valuation z-score, which I remember from my Statistics class equates to the number of standard deviations from the mean, has approached 3, a level we haven’t seen since the depths of the 2008 financial crisis. For context, anything above +1 signals CRE is relatively cheap versus the market. Having a technology background, I know little about commercial real estate equity but wanted to see how the largest commercial equity companies stacked up especially vis a vis the data center players.

For software stocks- gross margins, ARR growth rate, GRR, NRR and free cash flow margins are the key metrics but with CRE its quite different. Real estate companies are valued on FFO and AFFO, why you ask? Lets dig in.

As public companies, commercial real estate companies need to follow GAAP guidelines that require them to depreciate their assets over their useful lives (i.e. 39-40 years for commercial buildings) which has a large drag on reported eps. So unlike GPUs who lose value yearly when the new version is faster and more efficient, prime real estate generally appreciates in value.

In order to get an accurate view of normal operating cash flow, the two key metrics used are FFO and AFFO. Funds from Operations (FFO) adds back the depreciation and amortization related to the real estate and then removes gains/losses from property sales because they are non-recurring. Adjusted Funds from Operations (AFFO) goes even further to compute the true operating cash flow from the business by deducting the normal capital expenditures needed to maintain the properties. AFFO also smooths out rent adjustments.

The Challenge

I wanted to quickly analyze the major players across CRE subsectors. Traditionally, this means pulling 10Qs, normalizing metrics across different reporting conventions, and manually building a comp table.

Building the Model with Scout

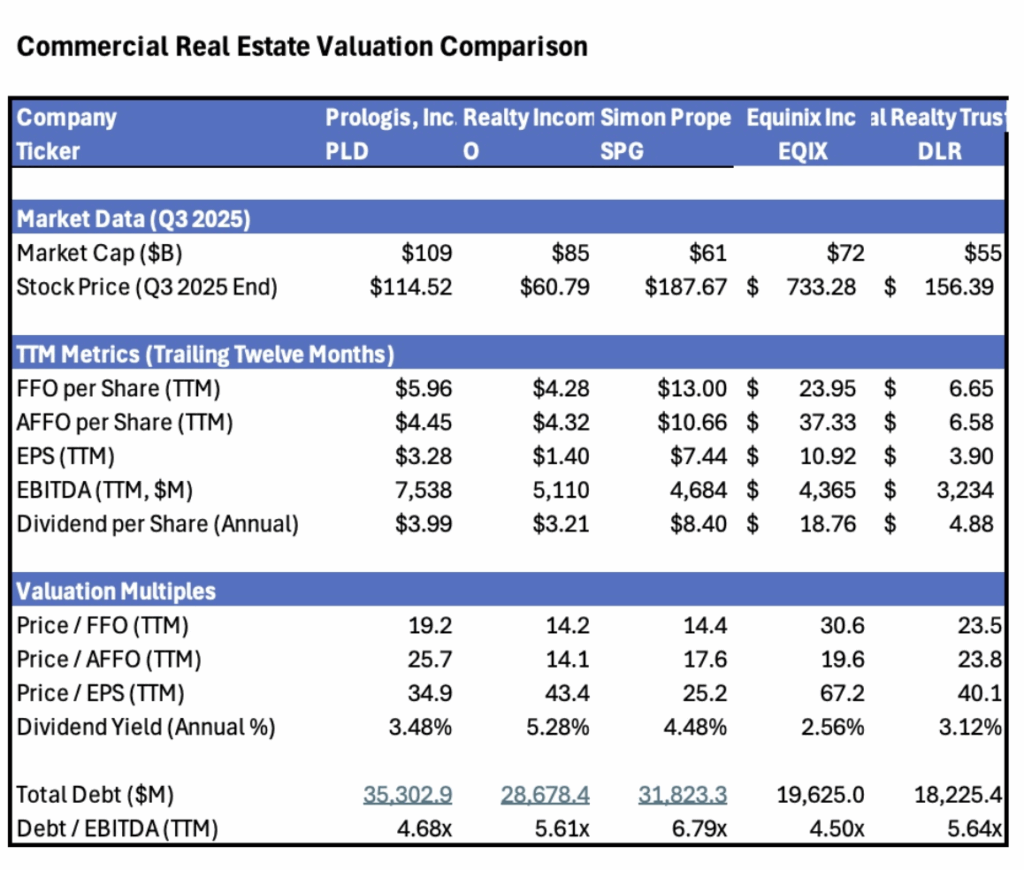

Scout let me pull together a comprehensive valuation comparison in minutes. I started with five REITs spanning different CRE segments. Prologis (Industrial/Logistics), Realty Income (Triple-Net Retail) and Simon Property Group (Regional malls) are more traditional commercial real estate companies while Equinix and Digital Realty operate data centers.

For each company, I pulled TTM metrics across the key REIT-specific KPIs: FFO per share, AFFO per share, EPS, EBITDA, and dividends. Scout normalized everything to trailing twelve months automatically, summing the last four quarters (2024Q4 through 2025Q3) without requiring manual adjustments.

What the Data Shows

The resulting model surfaces some interesting disparities:

Valuation spreads are wide. Price/AFFO ranges from mid-teens for Realty Income and SPG while the data center companies are in low twenty times. Prologis trades at the highest relative AFFO multiple, will need to drill in there to see why the hefty premium. Traditional retail-oriented REITs are trading at meaningful discounts to data center plays no surprise given AI infrastructure demand, but the spread is notable.

Dividend yields vary significantly. Realty Income leads at 5.3%, while Equinix yields just 2.6%. For income-focused investors, the yield pickup in traditional REITs versus data centers is substantial.

Balance sheet quality differs. Debt/EBITDA of 4.7x at Prologis versus 5.6x at Realty Income shows the range of leverage across the group. Lower leverage provides more flexibility if rates stay elevated longer than expected.

Why This Matters

The macro setup is compelling: CRE valuations at multi-decade relative lows, potential Fed easing on the horizon, and divergent fundamentals across subsectors. Having standardized, quarterly data across companies lets you move quickly from thesis to actionable analysis.

What would have taken hours of manual work involving downloading filings, finding the right line items, normalizing for fiscal year differences, Scout compressed into minutes. The output is a clean, auditable model I can update each quarter as new data flows in. Scout also allows adding other companies and metrics to the model by directing it in the prompt via the add-in.

For anyone evaluating CRE exposure, whether you are overweight data centers and curious about rotating into traditional REITs, or underweight the sector entirely and looking for entry points, having this kind of rapid industry modeling capability changes the workflow entirely.