The AI Integration Crisis—and Its Solution

Your bank has 47 AI agents. None of them talk to each other.

The fraud detection system flagged a suspicious wire transfer at 2:47 AM. The customer onboarding system—sitting three cubicles away in server terms—had already verified this same customer’s employment, income, and transaction history last week. But those systems don’t share context. So a risk analyst will spend four hours tomorrow reconstructing information that already exists, scattered across databases that might as well be on different continents.

This disconnection can cost financial institutions millions annually in redundant integration work, missed fraud patterns, and compliance gaps that fall between systems. The Model Context Protocol changes this calculus entirely.

Key Takeaways

- MCP is the “USB-C for AI”: A universal, open protocol that eliminates custom integration requirements between AI applications and data sources, solving the N×M integration problem that has paralyzed enterprise AI scaling.

- Five financial services roles transform within 90-180 days: Risk Analyst → Strategic Risk Orchestrator; Relationship Manager → Growth Partner; Compliance Officer → Policy Architect; Portfolio Manager → Strategy Validator; Financial Analyst → AI Orchestration Specialist.

- Quantified impact: AI-powered fraud detection achieves 87-94% detection rates versus 65-70% for rule-based systems.¹ HSBC reduced false positives by 60% while identifying 2-4x more suspicious activity.² JPMorgan has realized approximately $1.5 billion in AI-driven cost savings across fraud prevention, trading, and credit decisions.³

- Industry momentum accelerating: By late 2025, over 70% of financial institutions will utilize AI at scale, up from 30% in 2023.⁴

- Implementation timeline: Initial results visible within 90 days; full transformation achievable in 180 days with proper assessment, piloting, and phased rollout.

How MCP transforms financial services roles

Five positions can evolve from manual processors to strategic orchestrators within 90-180 days:

- Risk Analysts → Strategic Risk Orchestrators. Investigation time compresses from 8 hours to under 45 minutes. False positive rates drop 60%.² Coverage expands to analyze significantly more transactions per analyst.

- Relationship Managers → Client Growth Partners. Onboarding collapses from 14 days to under 2 hours through parallel verification across 12+ systems. Administrative tasks disappear; strategic advising time increases substantially.

- Compliance Officers → Policy Architects. Automated report compilation replaces manual aggregation across 15 systems. Regulatory update lag shrinks from 72 hours to real-time. Submission error rates drop dramatically.

- Portfolio Managers → Strategy Validators. Quarterly rebalancing becomes continuous micro-optimization. Generic portfolios transform into hyper-personalized strategies with predictive scenario planning.

- Financial Analysts → AI Orchestration Specialists. Manual data extraction from filings becomes automated with full source traceability. Model-building time drops substantially, with 99%+ accuracy and under 3% hallucination rates.

The measurable outcomes: institutions implementing MCP-enabled workflows report significant automation of routine tasks, faster decision cycles, and high compliance accuracy—with initial results visible within 90 days.

MCP isn’t another AI tool. It’s the architectural foundation that transforms disconnected experiments into an enterprise nervous system.

Explore how Daloopa MCP powers these transformations →

The $2.3M Integration Problem

The financial services industry has invested more in AI than almost any other sector—$35 billion in 2023, with banking accounting for approximately $21 billion.⁸ By late 2025, over 70% of institutions will utilize AI at scale, up from just 30% two years earlier, yet only 38% of AI projects meet ROI expectations and over 60% report significant implementation delays.⁴ The gap isn’t capability. It’s architecture.

Consider what happens when a portfolio manager wants to assess a client’s risk exposure across all holdings. The trading system knows positions. The risk engine knows market correlations. The compliance system knows regulatory constraints. The CRM knows client preferences. Each system speaks a different language, guards its data behind different authentication schemes, and updates on different schedules.

Connecting them requires custom code. Lots of it. For every new AI application that needs access to three data sources, developers write three integrations. When that application needs to share insights with two downstream systems, they write two more. This “N×M problem”—connecting N models to M data sources—has paralyzed AI scaling across the industry.

The Model Context Protocol for finance addresses this directly.

Anthropic open-sourced MCP in November 2024.⁵ Within months, OpenAI integrated it across ChatGPT, Agents SDK, and Responses API.⁶ Google DeepMind CEO Demis Hassabis confirmed support for Gemini in April 2025.⁷ Microsoft, SAP, Oracle, and Docker announced integration.¹¹ The community built thousands of MCP servers, with SDKs now available in Python, TypeScript, C#, and Java.

Think of MCP as USB-C for AI applications. Before USB-C, every device needed its own charger, its own cable, its own connection standard. MCP creates the same standardization for AI-to-data connections. Any AI model can plug into any data source through a single, consistent protocol.

This article examines three transformations MCP enables: how systems connect (technical), how work changes (operational), and how roles evolve (strategic).

The institutions moving first aren’t just gaining efficiency. They’re building enterprise AI architecture that will define competitive advantage for the next decade.

Understanding the Model Context Protocol Revolution

From Islands to Ecosystems: The Evolution of Financial AI

2020-2022: The Pilot Explosion

Banks launched AI experiments everywhere. Fraud detection. Customer service chatbots. Document processing. Trading algorithms. Risk scoring. By 2022, adoption reached 45% industry-wide, with institutions deploying 20, 30, sometimes 50+ discrete AI applications.

Each pilot delivered results within its narrow scope. Each pilot was an island.

A fraud detection model couldn’t share context with the onboarding system that had already verified a customer’s identity. A trading algorithm had no visibility into risk assessments happening in adjacent departments. Information that could prevent losses existed—but in systems that couldn’t communicate.

2023: The Integration Crisis

The bill came due. Integration costs exceeded initial AI investments. Teams that had celebrated successful pilots discovered they couldn’t scale them without rebuilding the entire data architecture.

The statistics tell the story: many companies abandoned AI initiatives as they struggled to move beyond proof-of-concept. CTOs frequently cite legacy system incompatibility as a primary barrier, with AI initiatives experiencing significant delays due to compatibility issues alone.

The problem was never AI capability. It was architectural fragmentation.

2024: The Protocol Emerges

MCP arrived in November 2024 as an open standard addressing fragmentation at its root.⁵ Rather than custom connectors between each application and data source, MCP established a universal protocol layer.

The design drew from proven patterns: message-flow concepts from the Language Server Protocol, transport over JSON-RPC 2.0. Developers recognized familiar architecture, which accelerated adoption dramatically.

2025: Industry Standardization

Adoption velocity exceeded typical enterprise technology cycles. Major platforms integrated within months. The community responded with thousands of server implementations. What started as Anthropic’s protocol became the industry default for AI-to-data integration.

Read more: Gen AI Hasn’t Transformed Finance Yet—But Daloopa MCP Is Here to Fix That

Core Principles of MCP

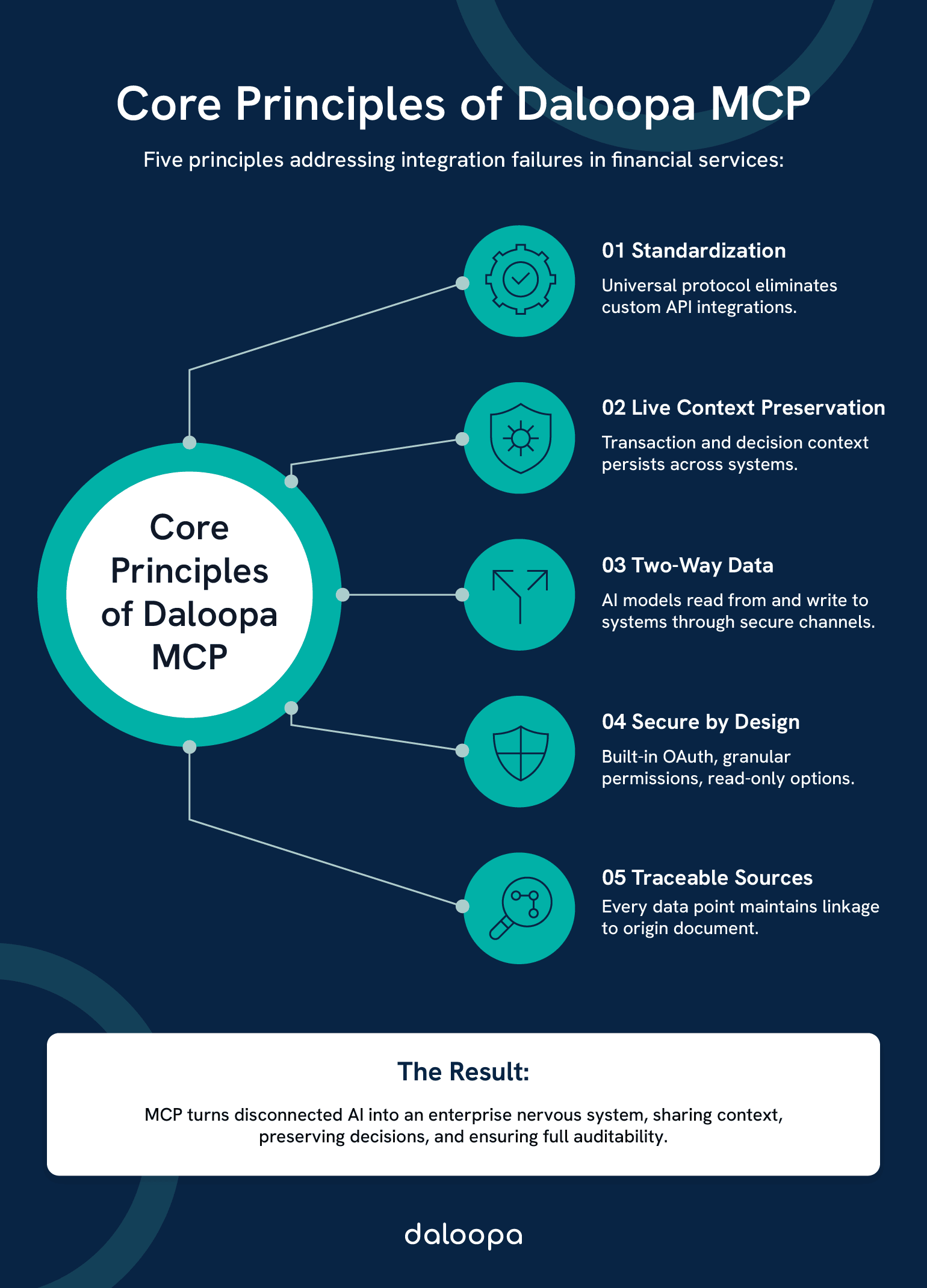

Five key principles address specific integration failure modes in MCP financial services implementations:

- Standardized Communication. Universal protocol replaces custom API integrations. When a large trade triggers risk thresholds, the compliance system receives context automatically—no custom webhook, no middleware translation.

- Real-time Context Preservation. Transaction and decision context persists across system boundaries. A fraud detection alert includes full transaction history, customer behavioral patterns, and related account activity. Previously, investigators spent hours manually compiling this context from multiple systems. Now, investigation time drops from 8 hours to under 45 minutes.

- Bidirectional Data Flow. AI models both read from and write to connected systems through secure, auditable channels. An AI agent analyzing earnings reports can query live databases, retrieve specific data points, and update internal models within a single workflow—with complete audit trail.

- Security-First Architecture. OAuth authentication, read-only server options, and granular permission controls are built into the protocol specification. Daloopa’s MCP implements read-only remote servers with OAuth authentication, meeting the highest authorization standards while enabling access to sensitive financial data. This architecture supports production deployment in regulated environments requiring SOC2/ISO27001 compliance.

- Source Traceability. Every data point maintains linkage to its origin document. Daloopa MCP overlays all referenced data with hyperlinks directing to source documents—SEC filings, press releases, investor presentations. Each data point undergoes quality assurance, achieving 99%+ accuracy across millions of datapoints and hallucination rates under 3%.

Technical Architecture

MCP defines a five-layer integration framework optimized for enterprise AI architecture in finance:

Layer 1: Data Ingestion. MCP servers expose structured access to SEC filings, earnings transcripts, investor presentations, real-time market feeds, internal transaction records, and KYC/AML databases. Daloopa’s MCP covers nearly 4,700 public companies globally, delivering 5-10x more data points than traditional providers—including company guidance and non-GAAP KPIs typically missing from standardized feeds.

Layer 2: Context Management. The protocol maintains state across multi-step workflows. When an analyst queries five years of financial history, context persists for follow-up questions, scenario modeling, and comparative analysis without re-establishing connections or re-authenticating.

Layer 3: Agent Communication. AI agents communicate through standardized JSON-RPC 2.0 messages. This enables orchestration of multi-agent systems, parallel processing across distributed infrastructure, and real-time collaboration between AI and human reviewers.

Layer 4: Security & Compliance. The framework incorporates OAuth 2.0 authentication, URL-based client registration (added in the November 2025 update), granular tool permissions, full audit logging, and secure out-of-band authentication via URL mode elicitation.¹¹

Layer 5: Output & Action. MCP-connected systems execute automated report generation, risk score calculations, alert generation, document creation, model updates, compliance submissions, transaction monitoring, and workflow state management. All operations maintain complete audit trails.

Technical Documentation: Daloopa MCP

Transformative Impact on Financial Roles

MCP doesn’t eliminate jobs. It eliminates tedium.

Reimagining Fraud Detection and Risk Management

The Role Today

Sarah arrives at 7:30 AM to 47 alerts flagged overnight. Her morning: pulling transaction histories from the core banking system (45 minutes), cross-referencing customer profiles in the CRM (30 minutes), checking watchlist databases through a separate portal (20 minutes), reviewing related account activity (1 hour), documenting findings in case management (30 minutes).

By noon, she’s investigated 6 cases. Four were false positives.

Traditional rule-based systems typically detect only 65-70% of fraudulent transactions while generating false positive rates often exceeding 30%.¹ Sarah’s expertise is consumed by data gathering rather than pattern analysis. Complex cases take 8+ hours each.

The Role Tomorrow

With MCP-enabled integration, Sarah’s workflow transforms. The system presents pre-enriched alerts with full context—transaction patterns, behavioral anomalies, related account activity, watchlist correlations—already compiled. AI pre-screening filters false positives; only high-confidence cases require human review.

Sarah’s morning becomes strategic: analyzing patterns across cases, identifying emerging fraud typologies, designing detection rules that prevent future incidents. Her expertise applies to strategy rather than data compilation.

Measured Results

- False positive reduction: 60% (verified across HSBC² and Danske Bank¹⁰ implementations).

- Investigation time: 8 hours to under 45 minutes per case.

- Coverage expansion: significantly more transactions analyzed per analyst.

- Detection accuracy: 87-94% with AI-powered systems versus 65-70% with rule-based approaches.¹

JPMorgan Chase has realized approximately $1.5 billion in cost savings through AI-driven improvements across fraud prevention, trading, and credit decisions.³ HSBC’s system analyzes over 1.2 billion transactions monthly while reducing review times from weeks to days.²

Revolutionizing Client Onboarding

The Current Marathon

Institutional client onboarding typically spans two weeks: document collection (3 days), KYC/AML screening (5 days), system setup (4 days), initial engagement (2 days).

Banks dedicate substantial resources to KYC and AML tasks. Manual processes generate significant error rates. And up to 90% of companies lose potential customers during digital onboarding—clients lost before they generate a single dollar of revenue.

The 2-Hour Alternative

Parallel verification across 12+ systems executes simultaneously. Document extraction via OCR validates automatically. Real-time watchlist screening runs alongside beneficial ownership verification through connected registries. Automated risk scoring generates personalized product recommendations, enabling immediate account activation for qualifying applications.

Relationship managers evolve from data entry specialists and document chasers into strategic advisors and growth partners. Time freed from administration redirects to client strategy, portfolio advisory, and relationship development.

Measured Results

Onboarding time reduction: up to 80%. KYC cost reduction: substantial savings reported across implementations. Case completion time: significantly faster. Operational capacity increase: 30-35%. Some automated KYC AML review processes improve from 45 minutes to under one minute.

Read more: MCP Strategy Game-Changer for Financial Analysis

Transforming Compliance and Reporting

The Current State

Compliance officers manually compile reports across 15 systems. Regulatory updates take 72 hours to integrate into workflows. Submission error rates require correction cycles that consume strategic bandwidth.

The MCP-Powered Function

Real-time regulatory monitoring triggers automatic workflow updates. Report generation draws from connected systems with full context preservation. Predictive compliance alerts flag potential issues before they become violations.

The role shifts from manual checking and report formatting to policy design, exception handling, and strategic regulatory advisory. Human oversight remains central for accountability—MCP handles data compilation and preliminary analysis while compliance professionals apply judgment.

Evolving Portfolio Management

Traditional Constraints

Quarterly rebalancing cycles. Generic model portfolios. Reactive responses to market changes. Templated, infrequent client communications.

Enhanced Capabilities

Continuous micro-rebalancing within defined parameters. Hyper-personalized strategies informed by individual circumstances, tax situations, and goals. Predictive scenario planning models multiple market futures with client-specific impact assessment.

Portfolio managers become relationship architects, strategy validators, and client educators—deepening trust through conversations rather than grinding through spreadsheets.

MCP Implementation Strategy: Your 180-Day Journey

Days 1-30: Assessment

Current State Audit: Inventory all AI applications and integrations. Map data flows between systems. Identify integration pain points and redundancies. Document compliance requirements.

Readiness Scorecard: Assess data accessibility, security posture, technical team capability, and executive sponsorship commitment.

Gap Analysis: Required versus available MCP servers. Custom development requirements. Training and change management needs.

Days 31-90: Foundation

Pilot Selection: Choose a high-impact, well-defined use case with manageable scope, clear metrics, engaged stakeholders, and existing data quality.

Infrastructure Preparation: Deploy MCP servers. Configure authentication and security. Implement monitoring and logging. Integrate with existing systems.

Team Formation: Technical implementation leads, business process owners, change management support, and executive sponsor engagement.

Days 91-150: Implementation

Integration Sequence: Connect priority data sources. Deploy initial AI agents. Implement financial workflow automation. Enable real-time monitoring.

Testing Protocols: Validate accuracy against manual processes. Benchmark performance. Conduct security testing. Complete user acceptance testing.

Rollout Strategy: Phased deployment by team or function. Parallel running with existing processes. Feedback collection and iteration.

Days 151-180: Optimization

Performance Benchmarking: Compare against pre-implementation baselines. Measure against targets. Identify optimization opportunities.

Scaling Decisions: Expand to additional use cases. Broader organizational rollout. Integration depth enhancement.

ROI Measurement: Quantify time savings, error rate reduction, cost impact, and strategic value.

Implementation Guide: MCP Step-by-Step

Ready to start your MCP journey? Explore Daloopa MCP capabilities →

Workforce Transformation

Emerging Roles

AI Orchestration Architect: Designs multi-agent workflows and optimizes system interactions across the enterprise.

Context Engineer: Ensures data quality and context preservation across integrations—the plumber who keeps information flowing.

Compliance Automation Specialist: Translates regulatory requirements into automated workflows that adapt to changing rules.

Client Intelligence Analyst: Synthesizes AI-generated insights into actionable client strategy.

Risk Pattern Designer: Develops detection strategies leveraging AI-identified patterns rather than static rules.

Reskilling Pathways

Technical Staff (8 weeks): MCP fundamentals and architecture, integration development, security implementation, optimization and monitoring.

Business Analysts (12 weeks): AI literacy, workflow analysis and design, change management, ROI measurement and stakeholder management.

Relationship Managers (6 weeks): AI-assisted client analysis tools, personalization systems, strategic advisory skill development.

Success Factors

Executive sponsorship with visible commitment. Clear communication about role evolution—not elimination. Training investment before deployment. Celebration of early wins to build momentum.

The Future Financial Landscape

2025-2026: Acceleration

MCP adoption accelerates as early implementers demonstrate ROI. Regulatory frameworks begin addressing AI integration requirements. Competitive pressure intensifies. Institutions without MCP infrastructure face growing disadvantages in efficiency and client experience.

2027-2028: Transformation

Industry structure shifts as MCP-enabled institutions operate at fundamentally different efficiency levels. New business models emerge leveraging real-time, AI-orchestrated operations. Client expectations reset around instant, personalized service.

2029-2030: Full Orchestration

Financial services approach complete orchestration—human oversight directing AI-executed operations. Career paths center on orchestration, strategy, and relationship management. The gap between AI-enabled and traditional institutions becomes the defining competitive divide.

Daloopa positions at the center of this transformation: the premier partner to Anthropic’s Claude for Finance, delivering the accurate, auditable data foundation that makes AI-orchestrated finance reliable.

Using the Daloopa Integration with Claude for Financial Analysis

Daloopa Financial Data MCP Prompts Library

The Strategic Imperative

Technical transformation: From N×M custom integrations to M+N standard connections. Universal protocol eliminates architectural fragmentation.

Operational transformation: From manual data gathering to AI-orchestrated workflows. Human expertise redirects from processing to judgment.

Strategic transformation: From reactive processing to proactive orchestration. Roles evolve from executing tasks to designing systems and relationships.

The Choice

Institutions implementing MCP now aren’t gaining incremental efficiency. They’re building infrastructure that defines competitive advantage for the next decade. Those waiting will face growing gaps in capability, cost structure, and client experience.

Three Starting Points

Assess. Inventory current AI applications and integration pain points.

Pilot. Identify a high-impact, well-scoped use case for initial implementation.

Explore. Evaluate Daloopa MCP for financial data integration—4,700+ companies, 10x data density, 99%+ accuracy, under 3% hallucination rate.

Your Organization in 18 Months

Risk analysts focusing on pattern strategy rather than data compilation. Relationship managers advising clients rather than chasing documents. Compliance teams designing policy rather than formatting reports. Portfolio managers deepening relationships rather than running spreadsheets. The transformation is already underway at leading institutions.

This isn’t distant future. Institutions implementing MCP today will operate this way within 18 months.

The Model Context Protocol for finance isn’t another AI tool to evaluate. It’s the architectural foundation that determines whether your AI investments create value—or remain expensive experiments.

Transform your financial operations with Daloopa MCP. See how leading institutions are achieving significant automation gains. Explore Daloopa MCP →

References

- GSC Online Press. “AI-Driven Fraud Detection in Banking: A Systematic Review.” GSC Advanced Research and Reviews, 2024.

- Google Cloud. “How HSBC Fights Money Launderers with Artificial Intelligence.” Google Cloud Blog, November 30, 2023.

- Reuters. “JPMorgan says AI helped boost sales, add clients in market turmoil.” May 6, 2025.

- Caspian One. “AI Adoption in Financial Services | 2025 Report.” April 2025.

- Anthropic. “Introducing the Model Context Protocol.” November 25, 2024.

- TechCrunch. “OpenAI Adopts Rival Anthropic’s Standard for Connecting AI Models to Data.” March 26, 2025.

- TechCrunch. “Google to Embrace Anthropic’s Standard for Connecting AI Models to Data.” April 9, 2025.

- Statista. “Artificial Intelligence (AI) in Finance – Statistics & Facts.” 2024.

- Techzine Global. “Model Context Protocol Receives Major Update on Its First Anniversary.” November 27, 2025.

- PR Newswire. “Danske Bank and Teradata Implement Artificial Intelligence (AI) Engine that Monitors Fraud in Real Time.” October 23, 2017.