Building a financial model in Excel demands precision, a deep understanding of financial principles, and advanced techniques. This guide goes beyond the basics to explore complex aspects of financial modeling, including creating robust financial statements, scenario analysis, and long-term projections. By leveraging Excel’s powerful functions, you’ll learn to build accurate, adaptable models that reflect current financial conditions and anticipate market changes. The step-by-step approach and best practices shared will enhance your model’s clarity, accuracy, and functionality, helping you elevate your financial modeling skills, whether you’re an experienced professional or an aspiring analyst.

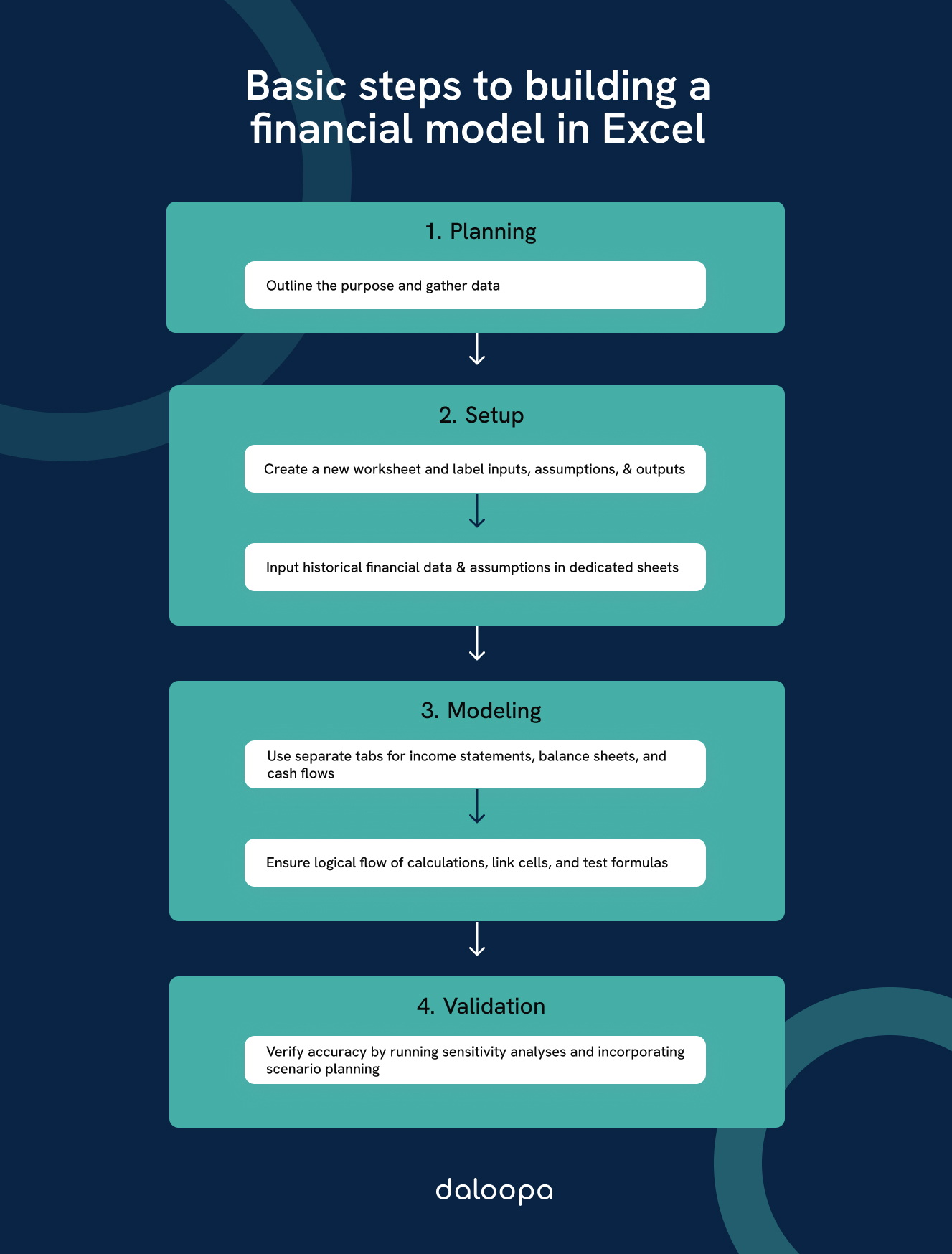

Step by Step Overview for Financial Model Construction

Step 1: Define the Purpose and Scope

Before diving into Excel, clearly define the purpose of your model. Are you creating a valuation model, a budget forecast, or a project finance model? Understanding the scope will help you determine the required inputs, outputs, and level of detail.

Step 2: Gather and Organize Data

Collect all necessary historical and projected data. This may include financial statements, market research, and industry benchmarks. Organize this information in a dedicated “Data” tab within your Excel workbook.

Step 3: Set Up the Model Structure

Create a logical structure for your model with separate worksheets for different components:

- Assumptions

- Income Statement

- Balance Sheet

- Cash Flow Statement

- Supporting Schedules

- Dashboard/Output

Use consistent formatting and color-coding to enhance readability and navigation.

Step 4: Build the Assumptions Tab

The assumptions tab is the foundation of your model. Include all key drivers and variables that will affect your projections. Examples include:

- Revenue growth rates

- Cost of goods sold (COGS) as a percentage of revenue

- Operating expenses

- Tax rates

- Working capital assumptions

- Capital expenditure projections

Step 5: Construct the Income Statement

Start with historical data and project future years based on your assumptions. Key components include:

- Revenue

- Cost of Goods Sold

- Gross Profit

- Operating Expenses

- EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization)

- Depreciation and Amortization

- EBIT (Earnings Before Interest and Taxes)

- Interest Expense

- Taxes

- Net Income

Ensure that all calculations are clearly visible and use cell references to link to the assumptions tab.

Step 6: Develop the Balance Sheet

Project the balance sheet items using the income statement projections and balance sheet assumptions. Key components include:

- Assets (Current and Non-current)

- Liabilities (Current and Non-current)

- Shareholders’ Equity

Remember to include a check to ensure that assets equal liabilities plus equity.

Step 7: Create the Cash Flow Statement

The cash flow statement shows how changes in balance sheet accounts and income affect cash and cash equivalents. It typically includes:

- Cash Flow from Operations

- Cash Flow from Investing

- Cash Flow from Financing

Use the indirect method to reconcile net income to cash flow from operations.

Step 8: Build Supporting Schedules

Develop detailed schedules to support your main financial statements. These may include:

- Revenue breakdown by product/service

- Detailed expense projections

- Debt schedule

- Fixed asset schedule and depreciation

- Working capital schedule

Step 9: Implement Error Checks and Sensitivity Analysis

Add error checks throughout your model to ensure accuracy:

- Balance sheet balancing

- Cash flow reconciliation

- Financial ratios within reasonable ranges

Implement sensitivity analysis to test how changes in key assumptions affect your model’s outputs.

Step 10: Create a Dashboard

Design a dashboard that summarizes key metrics and outputs from your model. This may include:

- Financial highlights

- Key performance indicators (KPIs)

- Charts and graphs

- Valuation summary (if applicable)

Step 11: Apply Best Practices

Throughout the modeling process, adhere to these best practices:

- Use consistent formatting and labeling

- Separate inputs, calculations, and outputs

- Use color-coding for different types of cells (e.g., blue for inputs, black for formulas)

- Avoid hard-coding numbers in formulas

- Use Excel functions efficiently (e.g., SUMIF, VLOOKUP, INDEX-MATCH)

- Document assumptions and methodologies

Step 12: Review and Test

Thoroughly review your model for errors and inconsistencies. Test extreme scenarios to ensure your model behaves as expected under various conditions.

Step 13: Build in Flexibility

Design your model to be flexible and easily updatable. Use dynamic named ranges and data tables to accommodate changes in time periods or scenarios.

Step 14: Consider Circularity

Some financial models may require circular references, such as interest calculations that depend on the cash balance. If needed, implement circularity carefully and use Excel’s iteration setting.

Step 15: Protect and Share

Once your model is complete, protect cells containing formulas to prevent accidental changes. If sharing the model, consider creating a version with inputs unlocked for users to modify.

Building a comprehensive financial model in Excel requires attention to detail, a strong understanding of financial concepts, and proficiency in Excel. By following this guide and continually practicing, you can develop robust financial models that provide valuable insights for decision-making.

Remember, financial modeling is both an art and a science. Continuous learning and practice are key to mastering this valuable skill.

Tips for modeling in Excel

When building a financial model in Excel, it’s essential to integrate robust functionalities and follow structured steps. This ensures accurate, efficient, and dynamic models that meet the business needs. As your skills progress here are a few things to focus on improving.

Utilizing macros and automation in financial modeling

Macros are powerful tools that automate repetitive tasks in financial modeling. Use the Record Macro feature to capture sequences of actions for playback.

Develop custom macros using VBA for specialized functions like data cleaning, report generation, and dynamic chart updates.

Ensure all macros are well-commented and tested to prevent errors. Automate scenario analysis and sensitivity testing with macros for rapid real-time adjustments. Integrate macro buttons in the model’s interface for easy user interaction.

Best practices for creating a statement model

Maintaining accuracy and clarity is paramount in financial modeling. Here are some best practices:

- Consistency: Use consistent formatting, including fonts, colors, and number formats.

- Documentation: Add notes and explanations for complex formulas or assumptions.

- Modularity: Design models in separate sections or modules to simplify updates and troubleshooting.

- Validation: Implement data validation to restrict inputs to acceptable ranges.

Regularly update and review assumptions driving the model. Adopting these best practices ensures the model remains user-friendly and reliable.

Error checking and troubleshooting techniques

Effective error checking safeguards the integrity of our financial model. Common techniques include:

- Audit Tools: Use Excel’s auditing tools like “Trace Precedents” and “Trace Dependents” to track the source and impact of data.

- Error Flags: Implement conditional formatting to highlight errors or unusual values.

- Reconciliations: Periodically reconcile model outputs with actual financial statements.

Additionally, conduct sensitivity analysis to understand how changes in key assumptions affect outcomes. This helps in identifying any inconsistencies and ensuring the model’s robustness and accuracy.

Analyzing Financial Statement Data for Modeling Purposes

Analyzing financial statement data is vital for making informed projections. We perform ratio analysis to evaluate profitability, efficiency, and liquidity. Key ratios like the current ratio, return on equity, and gross margin provide insights into the company’s performance.

Trend analysis helps identify patterns or shifts in financial data over multiple periods, aiding us in making realistic future projections.

We also employ scenario analysis to understand how different variables impact the financial model. By analyzing the financial statements accurately, we can build robust and reliable models that assist in strategic planning and decision-making. This methodical approach ensures our model reflects real-world financial scenarios effectively.

Long-term financial models

When building a long-term financial model, it’s crucial to consider various factors like consistency, adjustments for inflation, and potential market changes. Accurate forecasting techniques and incorporating significant long-term elements into the model ensure sustainable financial planning.

Considerations for long-term financial modeling

For long-term financial modeling, it’s important to maintain consistency in assumptions and methodologies used. We need to account for inflation, taxes, and interest rates. Adjusting these variables to reflect their likely changes over time provides a realistic outlook.

Considering the impact of market trends and potential disruptions is also key. This requires thorough market research and understanding potential risks. Long-term models should also account for planned capital expenditures and major investments. These expenditures often occur at varying intervals and can significantly impact cash flow and profitability.

Forecasting techniques for long-term projections

Accurate forecasting is essential for long-term financial projections. We can use several methods, including trend analysis and regression analysis. Trend analysis helps us identify patterns in historical data, allowing us to project future performance based on past trends. Regression analysis helps understand relationships between variables, such as sales and economic indicators.

Sensitivity analysis is another valuable technique. By varying key assumptions like cost of goods or sales growth, we can see how changes impact our financial projections. Scenario planning, which involves creating different potential future scenarios, helps us prepare for various market conditions.

Incorporating long-term factors into the model

Incorporating long-term factors requires us to include elements like economic cycles, regulatory changes, and technological advancements. These factors can significantly affect financial performance. Including economic indicators, such as GDP growth and inflation rates, helps us align our financial model with macroeconomic conditions.

Regulatory changes can impact industries significantly. We should stay updated on potential regulations that might affect our operations. Technological advancements can offer growth opportunities or pose threats; it’s essential to consider their impact on business models and financial outcomes.

Additionally, incorporating sustainability and environmental factors is becoming increasingly important. These elements influence investor decisions and long-term viability. By accounting for these varied long-term factors, our financial model remains robust and reflective of potential future conditions.

Common pitfalls to avoid in financial modeling

One common pitfall is overcomplicating the model. Keep it simple and avoid unnecessary complexity that hinders understanding and updates. Stick to clear formulas and reduce the use of nested functions where possible.

Another pitfall is neglecting to back up and version-control your models. Saving iterations ensures you can revert to previous versions if errors occur. Integrated tools like Excel’s version history can also help track changes.

Avoid hardcoding values within formulas. Instead, use cell references for inputs. This practice facilitates updates and reduces the chances of errors when assumptions change.

Want to improve your financial modeling in Excel?

Daloopa offers the advanced tools and data integration capabilities you need to build accurate, dynamic financial models with ease. Our platform streamlines data collection and updates, allowing you to focus on analysis and decision-making. Whether you’re crafting complex financial statements or running scenario analyses, our solutions enhance the accuracy, efficiency, and reliability of your Excel models. Create a free account today to see how Daloopa can optimize your financial modeling process.