You need a fast, defensible estimate of what your business is worth—one that doesn’t force you into pages of cash-flow forecasts or obscure accounting adjustments. This guide shows how to use turnover (annual revenue) and industry multiples to produce clear, actionable valuations you can defend in negotiations, planning, or fundraising; for workflows and practical Excel automation that support this approach, see the analyst-focused notes on automating revenue and model updates. By combining company valuation based on turnover with analyzing historical financial performance, you can gain a more complete view of your business’s worth.

Key Takeaways

- Turnover-based valuation measures worth by applying revenue multiples.

- Industry benchmarks help refine the reliability of results.

- Adjustments and professional judgment improve accuracy.

Turnover-Based Valuation Fundamentals

Company valuation based on turnover uses annual sales as the backbone of your estimate. You multiply the company’s turnover by a sector-appropriate multiple and then layer on adjustments for the business’s realities. This approach is simple to apply, transparent to most stakeholders, and especially useful when profit numbers are volatile or unreliable.

Definition Of Turnover In Business Context (Annual Revenue/Sales)

Turnover equals the total sales you record in a 12-month period from core business activity. It excludes incidental items like one-time asset sales or interest income. Because turnover is usually the least contested number in a set of financials, it makes an accessible base for company valuation based on turnover.

Distinction Between Turnover And Profit

Turnover shows demand; profit shows efficiency. Two companies can have identical turnover but wildly different profitability because of cost structure, scale efficiencies, or pricing power. When you use turnover multiples, keep in mind what you’re measuring: market traction and scale more than margin performance.

Situations Where Turnover-Based Valuation Is Most Appropriate

Use turnover multiples when your earnings are suppressed by growth reinvestment, when historical profits are irregular, or when you run a business where recurring revenue (e.g., subscriptions, ARR) better signals future cash flow than one-off margins. For many early-stage or fast-growing firms, this gives a fairer picture of potential.

The Revenue Multiple Method Explained

The revenue multiple method links turnover to sector-specific multipliers, giving business owners a straightforward way to estimate value. Because it draws on actual sales data, it provides a direct and approachable starting point.

Basic Formula: Business Value = Annual Turnover × Industry Multiplier

The formula is simple:

Business Value = Annual Turnover × Industry Multiplier

Annual turnover represents a company’s sales over a year. The multiplier comes from comparable businesses in the same sector. For instance, a local retail shop may use lower multiples than a software company because their growth potential and margins differ.

Keep it simple, but be rigorous about your inputs: audited turnover, comparable transactions, and up-to-date sector multiples. Using a company valuation based on turnover in combination with analyzing historical financial performance ensures accuracy and defensibility.

Historical Development Of Revenue Multiple Approaches

Multiples have been part of valuation practice for decades — they gained prominence in sectors where earnings didn’t reflect growth potential (e.g., early internet firms). Today, multiples remain a fast, market-referenced tool, often used alongside DCF or earnings multiples to triangulate a range, a crucial step for accurate company valuation based on turnover. Historical context also supports analyzing historical financial performance to fine-tune multiples for your sector.

Advantages Of Simplicity And Accessibility For Small Business Owners

The biggest strength of revenue multiples lies in their simplicity. Small business owners can apply them without advanced financial training, using just turnover figures and sector benchmarks. This method complements other small business valuation methods for a holistic approach.

Limitations Compared To More Complex Valuation Methods

The revenue multiple approach comes with limits. It overlooks profitability, cost structure, and long-term cash flow—factors that often shape true business value. Two companies with the same turnover may have very different earnings power. For a robust company valuation based on turnover, cross-referencing with analyzing historical financial performance is advised.

When To Use Turnover-Based Valuation

Turnover-based valuation is most useful when profits are unstable or not yet reliable. It anchors value to sales, offering an alternative when earnings or asset-based figures fail to reflect future potential. Combining this with other small business valuation methods increases confidence in your estimate.

Ideal For:

- Early-stage businesses with strong revenue traction but thin or negative earnings.

- Companies intentionally suppressing earnings due to scale investments (new stores, R&D, customer acquisition).

- Industries where revenue closely maps to long-term value, like subscription software or advertising platforms.

When to Avoid It

If profitability explains most of the enterprise’s value (asset-heavy manufacturing with steady margins, regulated utilities, or real estate portfolios), rely more on earnings or asset approaches and use turnover multiples only as a cross check.

Comparison With Other Valuation Approaches

Turnover-based valuation differs from other models, each with its own purpose:

| Method | Best Use Case | Limitation |

| Turnover-Based | Early-stage or growth-focused firms | Does not measure efficiency or profitability; still crucial for company valuation based on turnover. |

| Asset-Based | Asset-heavy industries (real estate, manufacturing) | May undervalue digital or service-based companies; complements small business valuation methods. |

| Earnings-Based | Mature firms with predictable profits | Misleading if earnings are suppressed or uneven; consider analyzing historical financial performance. |

Using company valuation based on turnover alongside other small business valuation methods increases the reliability of your assessment.

Industry-Specific Multipliers And Benchmarks

Turnover-based valuation works best when adjusted for sector standards. Revenue multiples shift across industries because cost structures, risks, and growth potential vary.

Sector Variation In Revenue Multiples

Industries apply different multiples because the relationship between sales and long-term value differs. Software firms often earn higher multiples than manufacturers due to recurring sales and low scaling costs.

Service-oriented firms with limited physical assets may also see higher multiples compared to industries requiring heavy infrastructure. This reflects scalability and flexibility.

Premium niches, such as luxury fashion, can attract higher multiples thanks to strong branding. Commodity-based industries, on the other hand, tend to show lower multiples due to volatility.

A basic comparison:

- Software / SaaS: ~2×–8× ARR for private comp sets; public/strong growth names can trade higher.

- Consumer / Retail: ~0.5×–3× turnover depending on scale and channel.

- Manufacturing: ~0.5×–2×, often lower due to capital demands.

Factors Affecting Industry Multipliers

Several drivers explain why one sector commands higher multiples than another.

- Growth expectations are key—fast-expanding markets typically support stronger figures.

- Risk also plays a role. Predictable cash flow industries, such as healthcare, often maintain higher multiples than those tied to cyclical demand.

- Capital requirements matter. Companies with high infrastructure needs tend to attract lower multiples since a greater portion of revenue supports maintenance and financing.

- Market maturity also shapes valuation. Emerging industries may command speculative premiums, while established markets typically trade closer to steady averages.

Sourcing Reliable Industry Benchmarks

Use multiple inputs: public filings, sector reports (PitchBook, Cantor, industry whitepapers), and specialized valuation studies (BVR). Cross-check transaction data against public comps to avoid over-relying on a single sample.

Adjusting The Basic Turnover Multiple

Flat multiples rarely reflect the true value of a business. Adjustments based on revenue quality, efficiency, and competitive edge provide a more accurate picture.

Revenue Quality Assessment

- Recurring vs one-off: Recurring revenue (ARR/subscriptions) usually commands a premium because predictability lowers risk.

- Customer concentration: If 40% of turnover comes from one client, reduce the multiple; if that client is stable with long contracts, soften the haircut.

- Revenue recognition: Normalize aggressively booked sales or backlog that won’t convert to cash this year.

Operational Efficiency Considerations

Check margins and working capital needs. If your gross margin substantially beats sector medians, you can justify a higher multiple; frail margins or slow AR collections demand a discount. Use efficiency metrics (inventory turns, days sales outstanding) as adjustment levers.

Market Position And Competitive Advantage

Patents, proprietary technology, or a recognized brand can push your multiple above peers. Quantify how much of turnover is protected by these assets — if they enable pricing power or stickiness, treat them like tangible multiple uplift.

Practical Application Of Turnover-Based Valuation

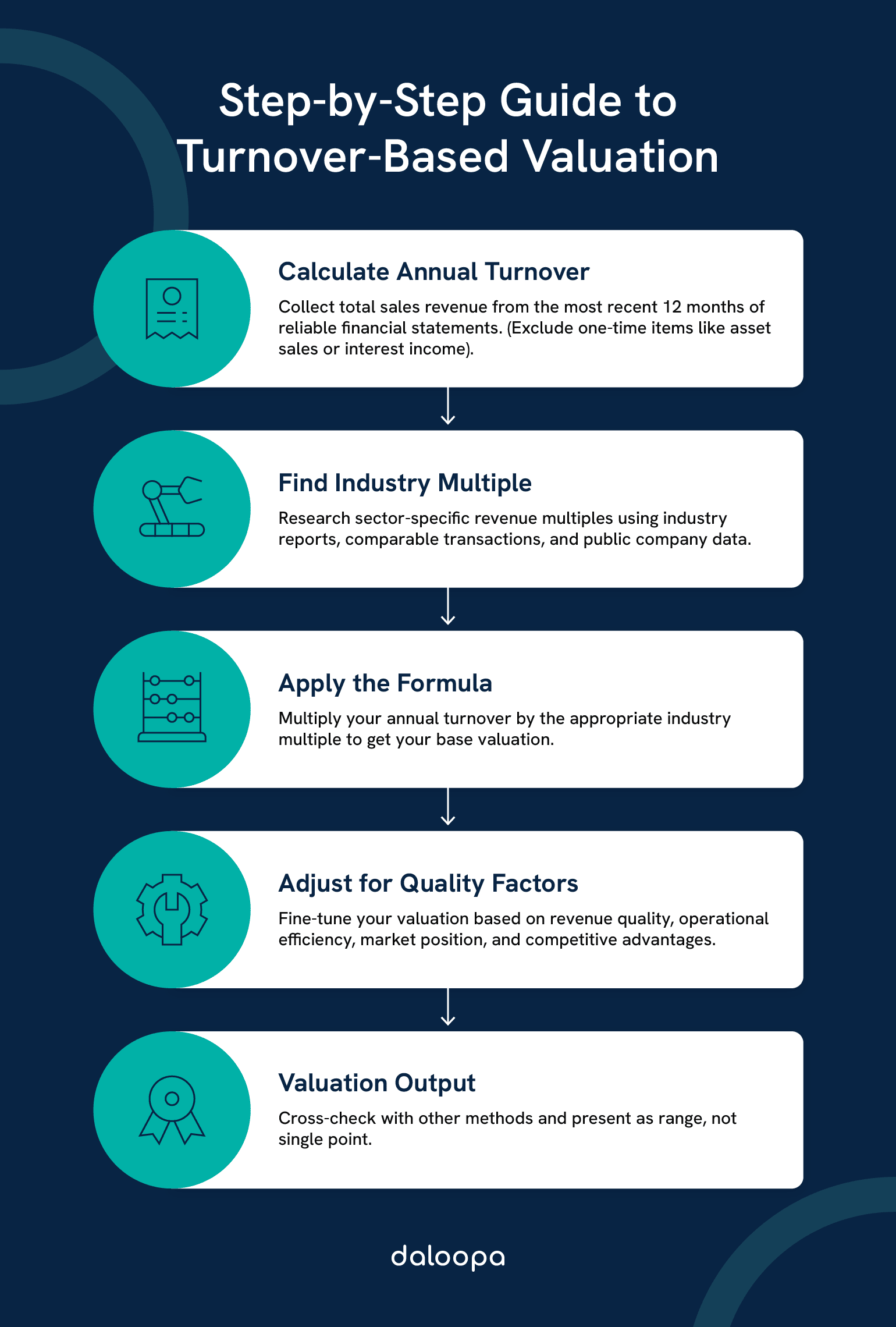

Applying turnover-based valuation involves a clear sequence of steps. The process uses revenue as the base, applies sector multiples, and adjusts for company-specific details.

Step-By-Step Valuation Process

- Collect turnover from the most recent 12 months of reliable statements (audit or reviewed preferred).

- Select sector multiple by combining public comps, transaction databases, and industry reports. Use the midpoint when ranges are wide.

- Normalize turnover for one-offs, seasonality, or accounting quirks.

- Adjust the multiple for revenue quality, efficiency, customer concentration, and intangible protections.

- Triangulate with at least one other method (earnings multiple or an asset check) and present a valuation range rather than a single point.

Common Mistakes To Avoid

- Applying a tech multiple to a local service business.

- Using unaudited revenue without normalization.

- Forgetting to factor in recent material events (loss of a contract, new regulation).

- Treating the valuation as deterministic rather than a sensitivity table or range.

Advanced Considerations For Turnover-Based Valuation

While turnover-based valuation is quick, accuracy improves when it accounts for growth, risks, and intangibles. These adjustments move the estimate from a rough outline to a more thoughtful assessment.

Integrating Growth Projections

Value depends on future, not just current, sales. Use credible CAGR estimates tied to historical performance and market growth. For SaaS, link valuation to ARR growth and churn metrics; for retail, model same-store sales trends. When you forecast, stress-test upside and downside scenarios.

Risk Assessment And Mitigation

Group risks and propose mitigations — then let them inform your multiple adjustments.

| Risk type | Example | How It Affects Multiple |

| Operational | Key sales manager leaves and takes two major accounts | Apply a temporary 10–20% haircut to multiple until retention is proven. |

| Financial | Company carries large short-term debt maturing in 6 months | Lower multiple; require debt refinancing assumptions. |

| Market | New marketplace app adds delivery fees and steals 15% of local food orders | Discount multiple and stress revenue forecast for 12–18 months. |

| Regulatory | New licensing rules increase compliance costs 8–12% | Reduce multiple until you can show margin recovery. |

These specific scenarios make the valuation defensible during negotiation because they tie a numeric adjustment to tangible business events.

Intellectual Property And Intangible Assets

If you rely heavily on customer lists, algorithms, or patents, quantify how those assets shorten customer acquisition costs or improve retention. Translate that advantage into a percentage uplift and document your assumptions. If you can show evidence (licenses, court records, or renewal rates), the uplift becomes credible.

Want a one-click way to test this on your spreadsheet?

Power your next valuation with Daloopa’s Excel Plugin — automate turnover normalization, pull verified line items, and test multiples across scenarios so your pitch stands up under scrutiny.

Get started with our automated company valuation tools. Request a free demo to connect your spreadsheet in minutes and watch valuation scenarios update automatically.