Your board doesn’t care that your team is drowning in reconciliations. They expect answers on demand. Investors and board members want forward-looking insights, not excuses about manual bottlenecks. Yet every quarter, finance teams find themselves trapped in the same cycle: late nights wrestling spreadsheets, double-checking filings, and praying no error slips through.

As of 2025, AI is breaking that cycle. With developments like Excel-native AI integrations and upgraded LLM capabilities, weeks of manual data extraction and reconciliation are being cut down to days, with fewer errors and richer insights. Companies are now adopting AI-powered earnings report analysis to accelerate close cycles, reduce manual errors, and provide executives with actionable insights in real time. Automated earnings data updates pull figures directly from filings, flag anomalies before they snowball, and surface predictive signals your team would never catch manually.

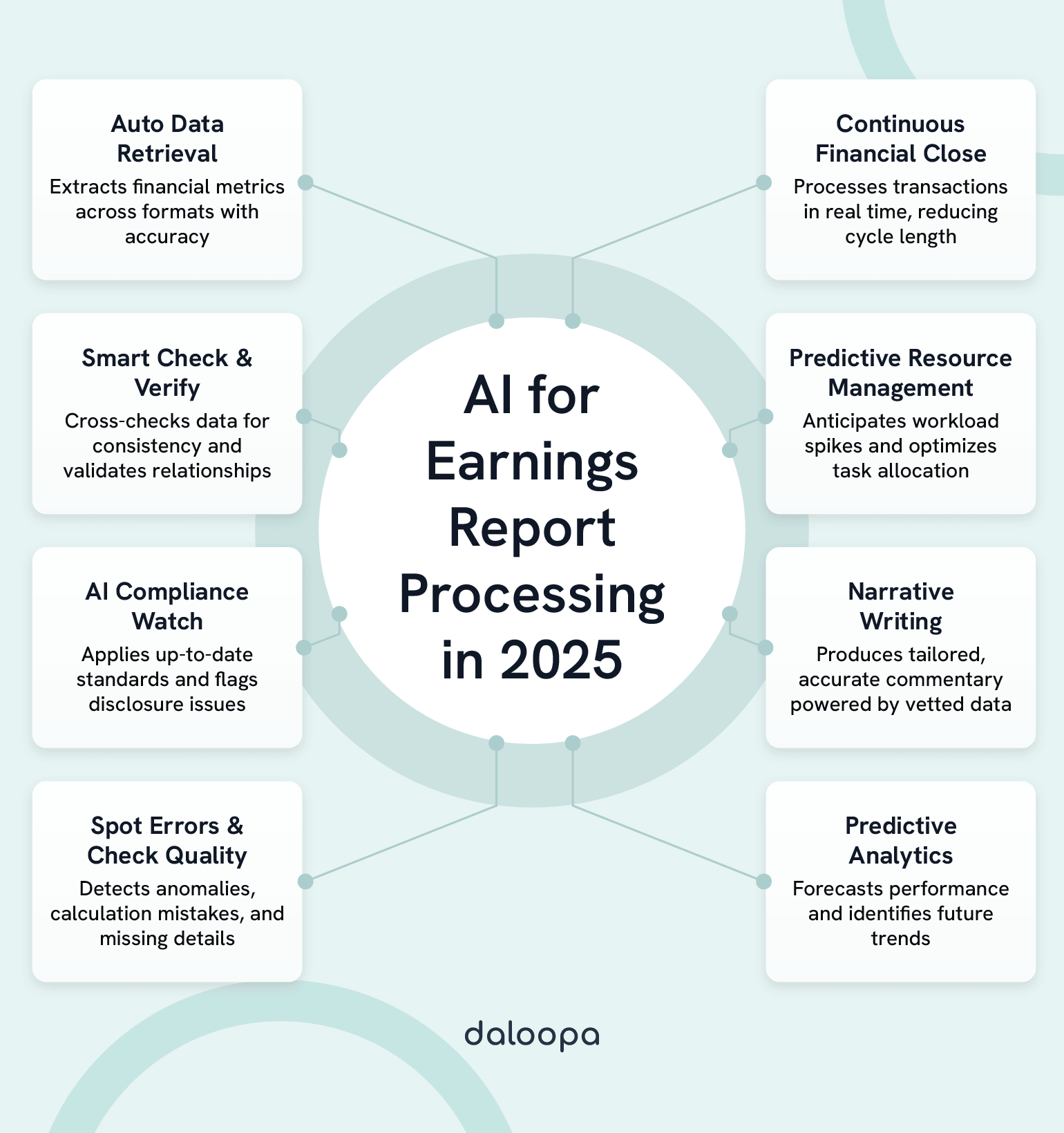

This shift demonstrates how AI is transforming earnings report processing, turning outdated workflows into streamlined, insight-driven operations.

Key Takeaways

- AI automates extraction and reconciliation, cutting report timelines from weeks to days while reducing errors.

- Machine learning reveals patterns and anomalies that support predictive insights beyond standard reporting.

- Finance teams redirect energy toward strategic analysis and delivering stronger insights to decision-makers.

AI-Driven Data Extraction and Processing

Today’s machine learning algorithms can scan thousands of financial documents in minutes and pull out key metrics automatically. Intelligent validation tools then cross-check figures against multiple sources to eliminate reconciliation errors that once consumed weeks of manual work. This demonstrates how AI is transforming earnings report processing by shifting hours of manual tasks into seconds of automated earnings data updates.

Automated Financial Data Harvesting

Machine learning algorithms trained on millions of financial documents recognize unusual formatting, parse tables, read footnotes, and interpret narrative disclosures. They work seamlessly across file formats such as PDFs, spreadsheets, and structured data feeds, consolidating everything in one workflow. This consolidation is another proof of how AI is transforming earnings report processing in 2025.

Natural language processing models have transformed how earnings data is extracted from filings, reports, and supporting materials. These tools read complex financial statements and locate figures like revenue, EBITDA, and cash flow with 99.2% accuracy. Relative to the industry average, Daloopa’s accuracy has consistently surpassed 99% since 2021, and in 2025 the company extended this level of data quality and performance further to LLM integrations.

Large language models built on financial vocabulary add context. They distinguish recurring versus one-time items, identify breakdowns by business segment, and extract prospective guidance from management commentary, tasks that previously required hours of manual reading. With Daloopa’s MCP, analysts can now connect LLM tools directly to complete, vetted financial datasets. This direct access to high-quality, auditable data ensures outputs are accurate, context-rich, and ready for immediate use in analysis and reporting.

A quarterly filing that once required 8–12 hours of manual work can now be processed in under ten minutes. That speed doesn’t just mean faster spreadsheets. It means the finance team can deliver guidance to the board days earlier and walk into earnings calls with confidence.

Intelligent Reconciliation and Validation

AI-powered reconciliation engines cross-reference figures across reports and data sources to quickly spot inconsistencies. These systems also compare current numbers to historical trends and flag deviations that exceed defined thresholds. This is a direct result of how AI is transforming earnings report processing—delivering accuracy, speed, and trust in financial disclosures.

Machine learning models study past data to predict common errors before they affect reports. They validate mathematical relationships between financial items, ensuring proper roll-ups and consolidation across entities.

Smart validation routines check financial models for accuracy. They confirm that balance sheets reconcile, cash flows match changes in balances, and income statements connect correctly to supporting schedules.

Financial data validation now also covers disclosure completeness and regulatory alignment. AI checks for missing details and verifies that statements meet formatting and content rules required by regulators.

This reduces audit risk, protects against regulatory penalties, and safeguards reputation with investors.

Enhanced Accuracy and Compliance Assurance

AI delivers rigorous compliance monitoring and proactive error detection, helping finance teams catch potential issues early. Instead of quality control slowing reporting cycles, automation ensures precision while creating reliable audit trails.

With AI-powered earnings report analysis, compliance reviews shrink from days to hours, giving CFOs defensible confidence when auditors or regulators review filings.

AI-Powered Compliance Monitoring

Compliance systems now use AI to continuously scan financial disclosures against SEC rules, GAAP standards, and international reporting requirements. Within seconds of data entry, the systems flag issues, keeping errors out of the final draft.

Systems automatically update as standards evolve, eliminating manual upkeep and ensuring reports stay aligned with shifting regulations, without adding workload to the finance team.

Key compliance features include:

- Automated validation of notes against disclosure rules

- Real-time checks against regulatory databases

- Instant alerts for missing mandatory disclosures

- Automatic formatting alignment with filing requirements

Advanced AI tools catch subtle misalignments between narrative commentary and numerical data that traditional systems often miss.

The payoff? Compliance reviews shrink from days to hours, and every step generates an audit-ready trail, giving you defensible confidence when regulators or auditors come calling.

With AI-powered earnings report analysis, CFOs gain real-time visibility into anomalies, compliance risks, and performance drivers that would otherwise take weeks to uncover.

Error Detection and Quality Control

AI-driven systems monitor earnings reports for inconsistencies, miscalculations, and anomalies across multiple sections at once. They study data quality patterns, identifying mistakes that human reviewers often overlook when deadlines loom.

Models trained on past earnings data recognize abnormal variance patterns in financial metrics and flag them for deeper review. They highlight outliers that may need further explanation or correction before reports are finalized.

Core error detection strengths include:

- Verifying consistency across documents

- Validating calculations automatically

- Detecting unusual historical variances

- Reconciling discrepancies in real time

These systems go beyond math checks. They ensure that management commentary aligns with reported figures, and they catch gaps, like missing disclosures or incomplete schedules, that could damage credibility with stakeholders.

Accelerated Reporting Timelines

AI is shortening close cycles by automating reconciliation and predicting workload issues before they cause delays. The result: faster closes, earlier guidance for the board, and fewer sleepless nights wondering if deadlines will slip.

Real-Time Financial Close Capabilities

Continuous processing replaces the old batch-based model. Transactions are categorized as they happen, keeping totals current throughout the reporting period.

Reconciliation engines now resolve discrepancies within hours. When algorithms detect unusual activity, they direct flagged items to team members, offering resolution suggestions based on prior cases.

This makes daily flash reports possible, giving executives a live view of revenue and expense drivers instead of waiting weeks for a final close. That speed turns financial reporting into a forward-looking management tool, not a historical exercise.

Integration tools connect multiple systems, from ERP platforms to banking feeds and subsidiary reports. AI consolidates them without manual intervention, producing a unified dataset for immediate review.

What once took weeks of pulling and reconciling data now runs continuously in the background. That means fewer last-minute panics and more time for scenario modeling before earnings calls.

Predictive Resource Allocation

Forecasting algorithms project workloads, predicting high-demand periods and identifying where added resources will be needed. These tools account for seasonal cycles, transaction volume, and business complexity.

Dynamic task routing assigns work based on team availability and expertise. The system balances urgency with individual workload to avoid bottlenecks during closing cycles.

Capacity planning models give weeks of advance notice about staffing needs. Leaders can schedule overtime or temporary help proactively rather than scrambling at the last minute.

Systems also track individual productivity trends and recommend areas for training or process redesign. They deliver suggestions based on real data instead of assumptions.

Risk alerts surface early warnings of delays, enabling managers to adjust plans before they cascade into missed deadlines. Instead of discovering problems days before the filing, you spot risks early and fix them before they hit the boardroom.

Strategic Insights and Analysis

AI is pushing reporting beyond compliance, transforming raw data into insights that drive decision-making. Automated earnings data updates and predictive models bring greater clarity to performance drivers and future outcomes. Reporting goes from “explaining the past” to actively shaping strategy and investor messaging.

This evolution is a hallmark of how AI is transforming earnings report processing—turning backward-looking reports into forward-looking strategy.

Narrative Generation and Explanation

Generative AI can now draft clear narratives from complex financial data. These tools analyze reports, statements, and performance metrics to automatically produce summaries that highlight what matters most.

While hallucination has been a huge hindrance in adopting generative AI in finance, largely due to unreliable data sources, Daloopa offers the perfect solution. Instead of the LLM scouring the internet and potentially getting inaccurate data from unvetted sources, analysts can link their AI tools to Daloopa’s verifiable financial data, eliminating the chance of returning incorrect outputs.

Modern systems also perform sentiment analysis of management commentary and filings. They identify subtle shifts in tone that suggest confidence levels or reveal underlying concerns, providing analysts with more context.

Narratives are automatically tailored. Boards see concise strategic summaries, while operational leaders receive detailed variance drivers.

Key narrative capabilities include:

- Automatic variance explanation

- Identification of risk drivers

- Contextualization of performance trends

- Communication tailored to different stakeholders

Predictive Performance Analytics

Predictive analytics uses past performance to forecast future outcomes. By analyzing multiple data streams at once, models reveal patterns and cycles that may be missed in manual reviews.

Quarterly performance can now be projected more accurately. Valuation models layer in real-time market sentiment, competitor activity, and macroeconomic signals to adjust forecasts dynamically.

AI-driven models spot trends earlier than the market. In one Stanford study, an AI analyst outperformed 93% of fund managers by generating $17.1 million in quarterly alpha through selective optimizations. This proves that predictive intelligence doesn’t just improve reporting, it creates a measurable competitive edge.

Predictive features include:

- Revenue forecasts with accuracy ranges

- Expense modeling with optimization paths

- Improved cash flow projections

- Correlation analysis linking markets and operations

The outcome? Finance teams step out of the role of “report compilers” and into the role of strategic advisors, turning quarterly reports into proactive playbooks for the business.

Human-AI Collaboration in Financial Reporting

Finance professionals are moving into more strategic roles as AI handles most of the repetitive work. This collaboration exemplifies how AI is transforming earnings report processing, freeing humans to focus on interpretation and strategy.

The Evolving Role of Financial Professionals

AI is shifting the finance function toward tasks that require judgment, communication, and oversight. Instead of crunching numbers, professionals now validate insights, manage exceptions, and translate financial impact for the business.

Strategic focus areas now include:

- Reviewing and validating AI outputs

- Handling exceptions and judgment-heavy cases

- Communicating insights to stakeholders

- Governing AI model use and oversight

With 70% less time spent on data-gathering, analysts finally focus on what executives actually value: interpreting results, flagging risks, and guiding strategy.

New hybrid roles are emerging:

- Finance data translators

- Digital controllers

- Treasury analytics specialists

- AI governance leads

These positions blend finance expertise with tech fluency. Companies are already adjusting pay scales to win professionals who can straddle both worlds.

AI can surface anomalies and trends. Humans still make the call on what matters and how to act. That judgment is what turns analysis into strategy.

Collaborative Workflows

The most effective reporting workflows combine AI-driven processing with human review at key stages.

Automated earnings data updates:

- Multi-system data extraction

- Early reconciliation checks

- Template population and formatting

- Initial compliance scans

AI completes up to 90% of this workload. Humans step in when exceptions arise or when interpretation requires context.

Human intervention checkpoints:

| Stage | AI Role | Human Role |

| Data Collection | Automated extraction | Exception handling |

| Analysis | Pattern identification | Context interpretation |

| Reporting | Draft generation | Narrative refinement |

| Review | Compliance validation | Final approval |

This structure reduces cycles from 15 days to about 5 on average, freeing teams to focus on strategy and communication.

Quality control is shared: AI detects anomalies, humans decide materiality and business impact. Dashboards keep the process transparent, showing both AI progress and where human oversight is required.

Implementation Challenges and Solutions

Even with strong advantages, adopting AI in earnings processing requires navigating security, governance, and organizational adoption challenges to ensure lasting success.

Data Governance and Security

Protecting confidential financial data is a top concern. AI systems must operate under strict access controls, limiting permissions to the appropriate data sets and personnel.

Teams need layered security frameworks including encryption, role-based authentication, and audit logs for every modification. Real-time monitoring ensures accountability throughout extraction and reconciliation.

Data lineage tracking ensures transparency in how figures are generated. Regulators and auditors can see exactly how raw numbers became final reports.

AI systems must also keep detailed logs of every processing action. Microsoft’s enterprise AI solutions show how various companies are deploying secure AI while maintaining governance standards across industries.

Change Management and Adoption

Resistance often stems from fear of replacement. Leaders must communicate that AI reduces repetitive work and creates time for higher-value analysis.

Training sessions should provide hands-on exposure to automated tools. Controllers need to test reconciliation engines, while analysts learn how to validate insights and verify algorithm outputs.

Phased adoption helps mitigate risk. Start with less critical monthly reports, then expand to quarterly earnings once teams build confidence in AI’s accuracy.

Success measures should highlight tangible outcomes: fewer hours spent on manual entry, lower reconciliation errors, and faster close times.

When teams see results documented, that is, less overtime, fewer errors, and quicker closes, support snowballs, and adoption stops feeling like a mandate.

Closing the Books on the Old Way

Earnings reporting doesn’t have to be a fire drill every quarter. AI has already proven it can shrink close cycles from weeks to days, eliminate error-prone manual reconciliations, and arm finance teams with predictive insights that sharpen strategy. What used to be a back-office grind is now a chance to step into the boardroom with confidence, insight, and time to spare.

This is the ultimate example of how AI is transforming earnings report processing into a discipline that empowers CFOs with speed, accuracy, and forward-looking intelligence. With tools like AI-powered earnings report analysis, the finance function steps into a more strategic role.

But transformation only sticks if you implement it with the right controls, the right workflows, and the right platform. That’s where Daloopa comes in. Purpose-built for finance teams, Daloopa automatically delivers the latest complete and accurate finance data into your workflow.

See how Daloopa can optimize your reporting cycle and turn your finance team into a true strategic partner.