When a revenue forecast misses by just 2%, the consequences cascade through risk committees, compliance reviews, and investor confidence. Financial teams across banking, asset management, and insurance face a critical challenge: your most valuable asset—spreadsheet data—demands hours of complex formulas and technical support for time-sensitive decisions. Large language models integrated with Excel solve this by enabling natural-language queries that deliver accurate, audit-ready analysis without requiring advanced technical skills, transforming how professionals extract insights while maintaining the regulatory standards financial decisions demand.

Key Takeaways

- LLMs enable direct natural-language interaction with financial spreadsheets, reducing reliance on complex formulas or specialist intervention.

- Strong data preparation practices help models interpret financial context correctly while aligning with industry requirements.

- Integration approaches combine automated analysis, visualization, and risk controls to produce comprehensive, decision-ready insight.

Understanding LLMs In Financial Analysis

Large language models bring advanced natural-language processing to spreadsheet analysis, allowing direct conversational interactions with your data. Connecting these systems to Excel shifts traditional manipulation into intuitive, question-driven workflows.

Core Capabilities Of LLMs For Financial Applications

LLMs process large volumes of financial text and numbers at once. The adoption is accelerating rapidly: McKinsey research shows that 78% of organizations now use AI in at least one function, with 71% regularly using generative AI. In financial services specifically, Deloitte’s 2024 survey of 540 financial leaders found that 46% are “pioneers” in generative AI adoption, with 74% of these leaders estimating ROI exceeding 10%.

Key technical strengths include:

- Text summarization for lengthy report content within spreadsheets

- Sentiment analysis for qualitative columns and annotations

- Pattern recognition across historical time series

- Reasoning about multi-variable financial relationships

For teams evaluating which model best fits your needs, our guide to choosing the right LLM for financial data analysis provides a detailed comparison framework.

Deep learning architectures help maintain context across large ranges. You can reference multiple sheets or files while the system keeps analytical coherence throughout a query.

The Excel-LLM Integration Paradigm

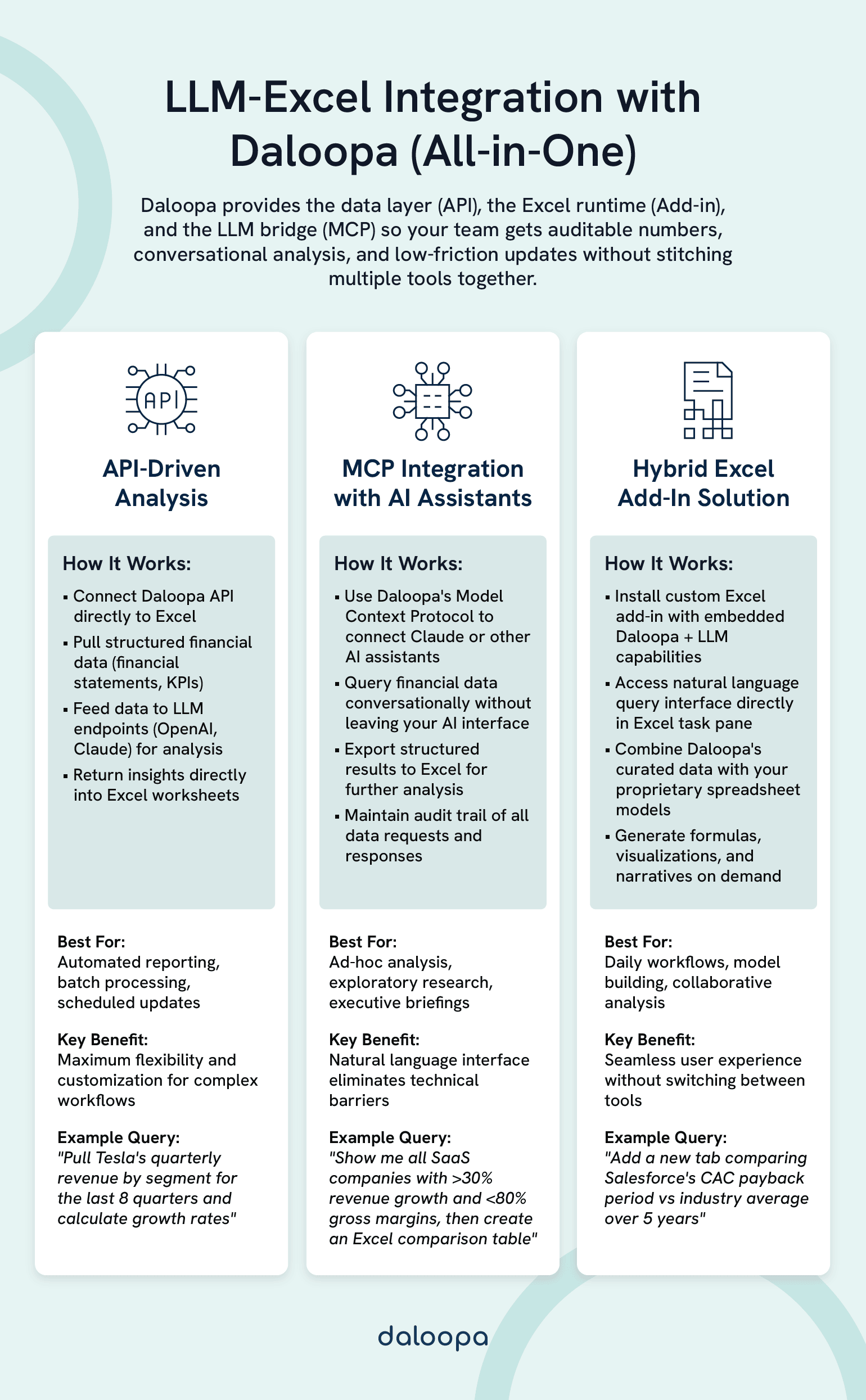

Excel connectivity generally follows three paths: API-based connections, plugin add-ins, and cloud processing. Direct links to models can be built with Office scripting or third-party extensions. For instance, when a CFO asks during a board meeting, “What’s our quarterly exposure to supply chain disruptions in Southeast Asia?”, an LLM-integrated Excel system can instantly aggregate supplier data, revenue dependencies, and risk metrics across multiple workbooks—analysis that previously required days of manual work.

Generative AI features replace many formula-heavy tasks with conversational requests. Instead of crafting VLOOKUP or SUMIF chains, you describe a goal in plain language. Platforms like Daloopa’s Model Context Protocol (MCP) enable Claude and other AI assistants to query financial data directly from Excel, bridging the gap between conversational AI and structured financial analysis.

LLM research shows the best results when structured Excel data is paired with natural-language inputs. Clear headers and consistent formats improve outcomes.

Integration strategies keep data intact while enabling flexible queries. Existing layouts stay in place, with LLM capability layered through interfaces that respect Excel’s native logic and calculation rules.

Technical Implementation Strategies

You can bring LLMs into Excel via three main routes: API connections to external models, custom add-ins that embed NLP features in the UI, and function-level extensions that compute inside cells. Each route involves tradeoffs around cost, performance, and deployment effort.

API-Based Integration Methods

REST APIs offer flexible access to advanced models such as GPT-4 or finance-specific systems like FinGPT. Configure requests via Power Query or VBA to send queries and receive structured results. For example, a risk analyst at a regional bank uses an API connection to query, “Show me all commercial real estate loans with LTV ratios above 80% and debt service coverage below 1.2x”—instantly filtering a 50,000-row portfolio that would take hours to analyze manually.

Authentication uses API keys stored securely. Rate limits matter because finance work often processes data in batches.

Key implementation steps:

- Set HTTP headers and credential handling correctly

- Add robust error handling for timeouts and failures

- Parse JSON responses to capture the fields you need

- Include retry logic for intermittent issues

Popular endpoints include Claude for Financial Services, OpenAI services, or privately hosted financial LLMs. Daloopa’s API provides structured financial data access that can be combined with LLM capabilities for comprehensive analysis workflows. Manage cost by trimming prompt length and caching frequent queries.

For live feeds, webhooks support real-time processing. For historical analysis, batch jobs provide predictable throughput where latency matters less.

Excel Add-In Development Approaches

Office JavaScript APIs let you build add-ins that bring LLM features into Excel’s task pane. Users can type natural-language requests and place results into targeted ranges.

Development uses HTML, CSS, and JavaScript. Authentication and permissioning run through Microsoft’s framework.

Core development components:

- A manifest that declares permissions and capabilities

- Task-pane UI for prompts and formatted results

- Background scripts that call the LLM endpoints

- Excel API calls to read and write cell ranges

VSTO add-ins built with C# or VB.NET reach deeper into the object model. You retain fine control over integration logic and resource use.

Distribution can go through AppSource or private channels. Adoption rises when the add-in feels native and keeps the workflow lightweight.

The Easier Alternative: Daloopa’s Pre-Built Solution

For teams that want immediate access to LLM-powered financial analysis without custom development, Daloopa’s Excel Add-in provides a production-ready solution. Rather than building authentication layers, data validation routines, and error-handling logic from scratch, you gain instant access to:

- Pre-integrated financial data from 5,000+ public companies

- Built-in data quality controls that prevent LLM hallucinations

- Native Excel functions that work alongside your existing formulas

- Automatic updates when companies report new financials

This approach eliminates months of development time while providing the same natural-language query capabilities through MCP integration or direct API access. Your team can start analyzing data the same day rather than building infrastructure for months.

Direct Formula and Function Extensions

Custom functions bring NLP directly into formulas with =LAMBDA() or VBA UDFs. Functions like =ANALYZE_FIN_TEXT(range, query) can run analysis without leaving the grid.

VBA UDFs run synchronously, which suits small-scale tasks. Add caching to reduce repeat calls when sheets recalc.

Implementation considerations:

- Handle mixed data types and ranges carefully

- Return values in formats that display cleanly

- Trap errors to avoid cascading #VALUE! states

- Optimize performance with memoization and batching

Financial Data Preparation And Enhancement

Effective use of LLMs starts with disciplined data prep that converts raw spreadsheets into consistent, context-rich datasets. Cleaning, enrichment, and metadata routines set the stage for trustworthy natural-language querying and reliable outputs.

Data Cleaning And Normalization Techniques

Standardize before analysis to avoid misreads. Remove duplicates, fix date formats, and normalize currencies to consistent decimals.

Critical cleaning steps include:

- Stripping special characters from numeric fields

- Normalizing company names and tickers

- Converting percentage formats to decimals

- Removing empty rows and placeholder text

For content from financial documents such as 10-K filings, extract structured elements from narrative sections. Management’s Discussion and Analysis offers useful signals but benefits from parsing that separates facts from commentary. For example, an analyst reviewing Tesla’s 10-K can use LLMs to extract only the forward-looking statements about production capacity while filtering out boilerplate risk disclosures.

Create consistent labels for text classification. Map industries, risk categories, and metrics to shared taxonomies that models can handle reliably.

Automated validation catches anomalies, gaps, or format issues early. That reduces failures when you later query the same data conversationally.

The Daloopa Advantage: Pre-Cleaned, AI-Verified Financial Data

Rather than spending hours cleaning and normalizing raw financial data before LLM analysis, Daloopa’s AI-powered platform handles this automatically. Our system combines machine learning with human analyst verification to deliver:

- Automated data extraction from earnings reports, 10-Ks, and regulatory filings

- Intelligent normalization that standardizes metrics across thousands of companies

- Continuous quality checks that catch anomalies before they reach your models

- Historical consistency maintained across restatements and reporting changes

Our AI approach uses deep learning models trained on millions of financial documents to understand context, detect errors, and flag inconsistencies—eliminating the manual data prep that typically consumes 60-80% of analysis time. When you integrate Daloopa data with LLM-powered Excel workflows, you start with clean, structured inputs that dramatically reduce the “garbage in, garbage out” risk that plagues traditional spreadsheet analysis.

Contextual Enrichment Of Financial Data

Boost financial data with context that sharpens interpretation. Add market indicators, sector benchmarks, and time windows to individual rows and columns.

Bringing in sentiment analysis converts qualitative inputs into quantitative features. For example, use FinBERT to score financial news, earnings transcripts, and analyst notes alongside the sheet.

Financial sentiment analysis methods include:

- Textual analysis of corporate communications

- Financial text analysis of regulatory filings

- Sentiment analysis in finance for market commentary

- Information extraction from earnings releases

Link related fields semantically. Tie balance-sheet items to footnotes, or align price moves with timed news events.

Add temporal layers such as rolling averages, trend flags, and seasonality markers. These features help LLMs answer nuanced questions.

| Enhancement Type | Data Source | LLM Benefit |

| Market Context | Industry benchmarks | Comparative analysis |

| Sentiment Data | News/Reports | Risk assessment |

| Historical Trends | Time series | Pattern recognition |

Metadata Management For LLM Processing

Adopt a metadata framework that guides model interpretation of your financial data. Document meanings, calculations, and lineage to reduce analytical mistakes.

Build data dictionaries that define each field, valid values, and relationships. Tag sensitive columns requiring special handling during textual data work.

Essential metadata elements:

- Field definitions with units and constraints

- Data source details and collection dates

- Quality indicators and confidence notes

- Access permissions and usage limits

Version datasets that change over time. Track modifications so queries always reference the intended snapshot.

Add semantic tags that signal purpose without lengthy prompts. Use standardized labels for revenue, expense, or performance metrics.

Record transformation rules and business logic used in prep. Clear documentation improves information extraction and supports validation against your internal standards.

Advanced Financial Analysis Applications

LLMs enable conversational exploration and automated statement reading, improving forecasting accuracy while cutting manual effort on complex datasets.

Natural Language Querying Of Financial Data

Ask plain-English questions instead of assembling nested formulas. A manager can say “What was quarterly revenue growth for the technology segment?” and receive the result without building a pivot.

Consider this real-world scenario: During a market downturn, a CFO needs to understand exposure across multiple dimensions. She asks: “Show me all clients in the hospitality sector with revenue over $50M who have credit lines maturing in Q2, and flag any with debt-to-EBITDA above 4x.” The LLM-integrated system instantly surfaces 23 high-risk accounts from a database of 12,000 clients, complete with contact information and covenant status—analysis that previously required coordinating between credit, operations, and risk teams over several days.

LLMs interpret finance terminology and context. Queries about cash-flow trends or debt-to-equity ratios resolve to the right ranges and calculations.

Key query types include:

- Revenue analysis by period or segment—”Compare Q4 software revenue to Q4 hardware revenue for the last three years”

- Expense classification and variance checks—”Why did SG&A increase 23% quarter-over-quarter?”

- KPI comparisons across business units—”Which region has the highest customer acquisition cost?”

- Period-over-period comparisons—”Show me gross margin trend for the past 8 quarters with year-over-year comparison”

These systems handle unstructured financial data mixed with tables. You can reference quarterly remarks, analyst notes, and numbers in one request. If you’re working with complex financial models, Daloopa’s LLM capabilities provide structured access to thousands of company fundamentals, enabling more sophisticated natural language queries.

This approach reduces the need for bespoke dashboards. Planning becomes more nimble when exploration flows through conversation rather than fixed reports.

Automated Financial Statement Analysis

LLMs extract and interpret metrics from balance sheets, income statements, and cash-flow statements. Automation trims processing time and raises consistency in financial forecasting tasks.

In practice, this transforms quarterly close processes. Instead of three analysts spending two days calculating and cross-checking ratios across 50 portfolio companies, one analyst reviews LLM-generated analysis in hours. The system automatically flags companies where current ratios dropped below 1.5x or where operating cash flow turned negative, surfacing risks that might otherwise hide in spreadsheet tabs until it’s too late.

They compute liquidity, profitability, and leverage ratios in standardized formats, even when statement designs vary by issuer.

Automated analysis capabilities:

- Balance-sheet reconciliation across periods

- Income-statement trend reviews and anomaly flags

- Cash-flow pattern checks and projections

- Cross-statement consistency tests

Your investment analysis benefits when models cross-reference documents. Links between statement components that humans might overlook surface quickly. Understanding whether LLMs can analyze financial statements well is critical for teams building these workflows—accuracy matters when decisions affect millions in capital allocation.

API links fit into current Excel files, so outputs can also support algorithmic trading research or portfolio workflows without uprooting models already in place.

Time Series Analysis And Forecasting

LLMs augment classic time-series methods by bringing in text signals with numeric patterns. Your financial forecasting improves when models consider market trends, news tone, and history together.

The business impact is measurable. McKinsey research found that generative AI could unlock $200-340 billion in annual value for the banking sector alone, with significant portions coming from improved forecasting and risk assessment. KPMG’s survey of 300 US finance leaders showed 92% meeting or exceeding ROI expectations from AI implementations.

They can detect seasonality, cycles, and structural breaks. Use this to forecast revenue, plan expenses, and refine investment strategies.

Forecasting applications include:

- Monthly revenue projections with confidence bands

- Expense variance predictions against budget

- Stock-movement context analysis

- Economic indicator trend reviews

Decision-makers receive plain-language explanations of forecast logic. Instead of interpreting dense statistics, you see why a trend is expected to continue or change.

Integration keeps existing charts and templates intact. Forecasts land directly in your workbooks for immediate use.

Visualization And Reporting Enhancements

LLMs speed up visual reporting by generating dashboards from natural-language instructions and by writing narratives that explain what changed and why. You interact with charts and commentary through conversational prompts, not manual setup.

Intelligent Dashboard Creation

Describe the view you want, and the system proposes charts and layouts suited to your data. It infers key metrics and selects effective visuals automatically. Trends align with line charts, expense splits appear as pies, and comparisons map to bars—guided by the structure of your sheet.

You can specify details through short requests like “Show quarterly revenue by region with variance analysis,” and receive a tailored, multi-panel layout with annotations.

Chat interfaces within Excel support quick adjustments. Change periods, filters, or chart types with a prompt instead of menus.

Narrative Generation For Financial Reports

Models generate written explanations to accompany visuals. They call out patterns, outliers, and trend shifts without manual commentary.

You get context that translates what the numbers mean for the business. A revenue jump receives a short explanation with likely drivers; a cost spike includes potential causes and options to investigate. For example, when presenting to the board, the CFO receives a pre-drafted executive summary: “Q3 revenue increased 18% year-over-year, driven primarily by 34% growth in cloud services offsetting a 12% decline in legacy hardware sales. Gross margin compressed 2.1 percentage points due to promotional pricing in EMEA, requiring attention in Q4 planning.”

Natural-language generation composes executive-level sections—from openers to key findings to recommendations—formatted for stakeholders and aligned with your terminology.

Narratives follow your internal style over time. The system learns phrasing from prior reports and applies it consistently to new outputs.

Interactive Exploration Interfaces

Virtual assistants inside Excel enable live exploration without pivot or formula skills. Ask “Which product lines show declining margins over six months?” and receive a view with supporting charts and a brief explanation.

These interfaces handle layered questions about relationships inside the data. Interactive prompts suggest follow-ups that help you dig deeper and surface adjacent insights.

With real-time responses, you iterate quickly as new questions arise. Curiosity turns into analysis with minimal friction.

Risk Management And Compliance Considerations

Deploying LLMs with Excel calls for structured validation, strong data protection, and reliable bias checks so decision-makers can trust outputs in regulated environments. The regulatory landscape is evolving rapidly: FINRA issued Regulatory Notice 24-09 in May 2024 reminding firms of their obligations when using generative AI, while the SEC has established an AI Task Force and proposed rules on predictive data analytics. In Europe, ESMA published guidance emphasizing transparency, governance, and client best interest when using AI in investment services.

Model Risk And Validation Approaches

Guard against misreads of formulas, formats, and layout quirks. Model risk grows when AI mishandles complex sheets or mixed units.

The stakes are substantial. Consider JPMorgan’s 2012 “London Whale” incident, where Excel errors in a Value-at-Risk model contributed to a $6.2 billion trading loss. The bank’s internal review found that the VaR model “operated through a series of Excel spreadsheets, which had to be completed manually, by a process of copying and pasting data from one spreadsheet to another.” A formula error divided by sum instead of average, causing the model to understate risk. The U.S. Senate investigation concluded this reflected inadequate model validation and governance—failures that cost the bank $920 million in regulatory fines beyond the trading losses.

Adopt continuous validation that tests outputs against benchmarks. Use seeded datasets with known anomalies to ensure outlier detection works for credit-risk scenarios. The Federal Reserve’s SR 11-7 guidance on Model Risk Management, though issued in 2011, remains the foundation for validating AI/ML models in banking. It emphasizes three pillars: effective model development, independent validation, and strong governance—all critical when deploying LLMs in financial workflows.

Maintain audit trails for all model decisions. Your framework should include:

- Input verification: Confirm integrity before processing.

- Output testing: Compare results with manual calculations.

- Performance monitoring: Track accuracy by data type.

- Version control: Record updates and configuration changes.

Insert human checks for high-impact actions. Analysts review alerts related to fraud, liquidity, or capital planning before acting.

Stress tests reveal weak points under shock conditions. Replay historic turmoil to find failure modes and tighten controls proactively.

Data Privacy And Security Frameworks

Excel-LLM setups touch sensitive records that demand strict safeguards. Customer data, transactions, and proprietary positions must remain protected throughout processing.

Favor private deployments or controlled cloud environments for confidential work. If external services are used, apply encryption, strict access control, and data-minimization practices.

Define governance policies that clarify:

- Who can use LLM features and at what scope

- Which data categories receive extra protection

- How long intermediate artifacts persist

- When temporary files are purged

Use role-based access so permissions mirror job duties. A compliance lead should not see the same fields as a general analyst.

Anonymize training and test samples where possible. Remove personal identifiers while preserving structure needed for risk analytics.

Log data flows end-to-end. Monitor every exchange between workbooks and LLM processors to satisfy regulatory review and detect misuse.

Fairness Considerations And Bias Mitigation

Models can propagate historical bias embedded in financial data, affecting credit scoring, customer evaluation, or trading signals. Uneven outcomes harm customers and expose firms to scrutiny.

Audit outputs regularly for disparate effects. Test identical financial profiles across groups to identify inconsistent recommendations.

Set up checks that examine:

- Loan recommendations across demographic slices

- Investment suggestions by client type

- Risk scores by region or socioeconomic markers

- Fraud-alert sensitivity across customer segments

Train analysts to spot bias patterns in model outputs. Staff should recognize when a recommendation reflects history rather than current risk drivers.

Build guardrails that flag questionable results before they influence decisions. Provide override mechanisms so human judgment can supersede model outputs when fairness concerns appear.

Document mitigation steps for review. Keep records showing active efforts to reduce bias and maintain fair treatment across products and channels. For organizations seeking to balance the pros and cons of using LLMs for financial analysis, robust fairness frameworks are non-negotiable.

Accelerate Your Financial Analysis with LLM-Ready Data

LLM-Excel integration strategies unlock significant productivity gains, but their effectiveness depends on one critical factor: access to high-quality, structured financial data.

Daloopa’s LLM integration provides AI assistants like Claude with direct access to detailed financial models covering thousands of public companies—from income statements and balance sheets to segment breakdowns and KPI histories. Whether you’re building custom Excel integrations or working directly with AI assistants through our Model Context Protocol, you gain:

- Instant access to standardized financial data optimized for LLM analysis

- Audit-ready accuracy eliminating the “hallucination” risk

- Comprehensive coverage across fundamentals, guidance, and historical trends

- Seamless integration with your existing Excel workflows via API or MCP

Instead of spending hours cleaning data and validating LLM outputs, your team can focus on the analysis that drives decisions. Explore how Daloopa powers LLM-based financial analysis or see our open-source benchmark measuring LLM accuracy in financial retrieval to understand why data quality matters for AI-driven workflows.

Ready to transform your financial analysis workflow? Learn more about our LLM integrations or Claude’s integration with Daloopa.